Question: Question 1 a. What is the Capital Asset Pricing Model (CAPM) and how is it used to evaluate whether the expected return on an asset

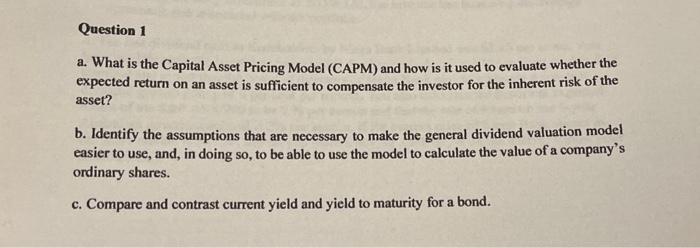

Question 1 a. What is the Capital Asset Pricing Model (CAPM) and how is it used to evaluate whether the expected return on an asset is sufficient to compensate the investor for the inherent risk of the asset? b. Identify the assumptions that are necessary to make the general dividend valuation model easier to use, and, in doing so, to be able to use the model to calculate the value of a company's ordinary shares. c. Compare and contrast current yield and yield to maturity for a bond

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock