Question: QUESTION 1 A hedge fund manager is interested in developing an asset pricing model that has factors on cybersecurity risk and the market risk. To

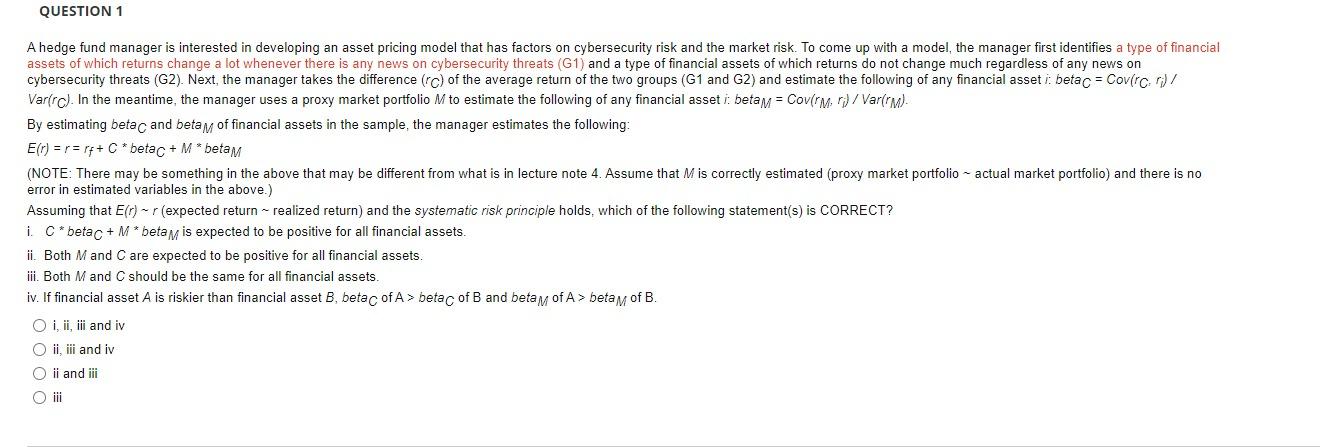

QUESTION 1 A hedge fund manager is interested in developing an asset pricing model that has factors on cybersecurity risk and the market risk. To come up with a model, the manager first identifies a type of financial assets of which returns change a lot whenever there is any news on cybersecurity threats (G1) and a type of financial assets of which returns do not change much regardless of any news on cybersecurity threats (G2). Next, the manager takes the difference (C) of the average return of the two groups (G1 and G2) and estimate the following of any financial asseti: betac = Covirc 01) / Var(rc). In the meantime, the manager uses a proxy market portfolio M to estimate the following of any financial asset i betam = Covirm, ) / Var(rm). By estimating betac and betam of financial assets in the sample, the manager estimates the following: E(r) = r = r4+ C * betac + M *betam (NOTE: There may be something in the above that may be different from what is in lecture note 4. Assume that M is correctly estimated (proxy market portfolio - actual market portfolio) and there is no error in estimated variables in the above.) Assuming that E(r) - r (expected return - realized return) and the systematic risk principle holds, which of the following statement(s) is CORRECT? i. C* betac + M * betam is expected to be positive for all financial assets. ii. Both M and C are expected to be positive for all financial assets. iii. Both M and C should be the same for all financial assets. iv. If financial asset A is riskier than financial asset B, beta c of A > betac of B and betam of A> betam of B. O i, ii, iii and iv O ii, iii and iv O ii and iii O ili QUESTION 1 A hedge fund manager is interested in developing an asset pricing model that has factors on cybersecurity risk and the market risk. To come up with a model, the manager first identifies a type of financial assets of which returns change a lot whenever there is any news on cybersecurity threats (G1) and a type of financial assets of which returns do not change much regardless of any news on cybersecurity threats (G2). Next, the manager takes the difference (C) of the average return of the two groups (G1 and G2) and estimate the following of any financial asseti: betac = Covirc 01) / Var(rc). In the meantime, the manager uses a proxy market portfolio M to estimate the following of any financial asset i betam = Covirm, ) / Var(rm). By estimating betac and betam of financial assets in the sample, the manager estimates the following: E(r) = r = r4+ C * betac + M *betam (NOTE: There may be something in the above that may be different from what is in lecture note 4. Assume that M is correctly estimated (proxy market portfolio - actual market portfolio) and there is no error in estimated variables in the above.) Assuming that E(r) - r (expected return - realized return) and the systematic risk principle holds, which of the following statement(s) is CORRECT? i. C* betac + M * betam is expected to be positive for all financial assets. ii. Both M and C are expected to be positive for all financial assets. iii. Both M and C should be the same for all financial assets. iv. If financial asset A is riskier than financial asset B, beta c of A > betac of B and betam of A> betam of B. O i, ii, iii and iv O ii, iii and iv O ii and iii O ili

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts