Question: QUESTION 1 Answer all parts. Tile Ltd. is concerned that two of its products, Cap and Curve may not be appropriately costed and priced, because

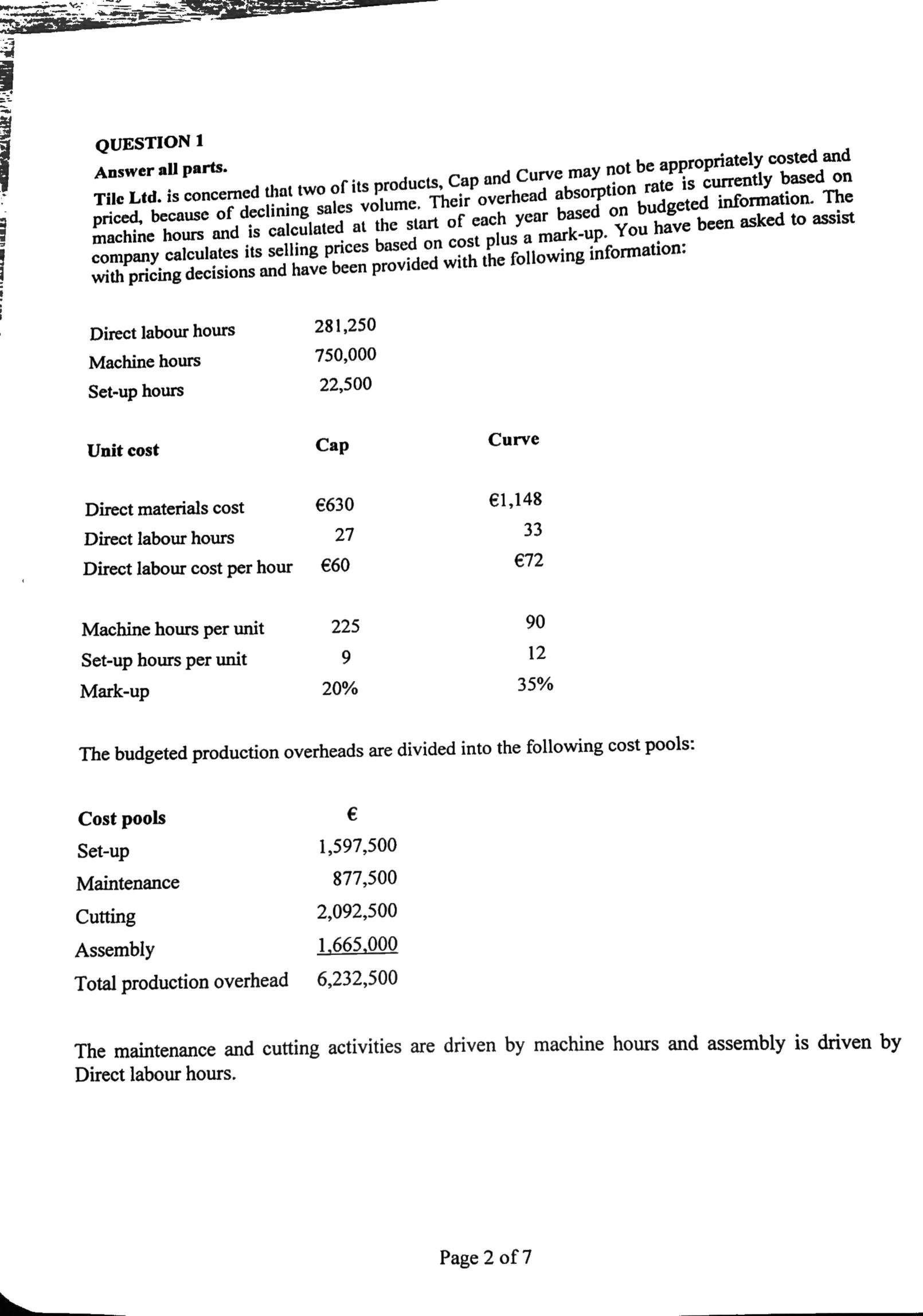

QUESTION 1 Answer all parts. Tile Ltd. is concerned that two of its products, Cap and Curve may not be appropriately costed and priced, because of declining sales volume. Their overhead absorption rate is currently based on machine hours and is calculated at the start of each year based on budgeted information. The company calculates its selling prices based on cost plus a mark-up. You have been asked to assist with pricing decisions and have been provided with the following information: The budgeted production overheads are divided into the following cost pools: The maintenance and cutting activities are driven by machine hours and assembly is driven by Direct labour hours. Required: (a) Using Tile Ltd's current method of absorbing production overhead, calculate the predetermined overhead absorption rate. (b) Calculate the standard cost and the standard selling price of both Cap and Curve, using the pre-determined overhead absorption rate that you have calculated in part (a) above. (c) Calculate the standard cost and the standard selling price of both Cap and Curve, using an activity-based costing approach. (d) Unit product cost measures should be treated with caution by users because they can be inherently subjective and at times reflect arbitrary choices by cost accounting system designers. Please discuss the above in the context of traditional costing and activity-based costing, giving practical examples of how this can arise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts