Question: QUESTION 2 Answer all parts. Charlic Ltd. is concerned that two of its products Nip and Tuk may not be appropriately costed and priced. This

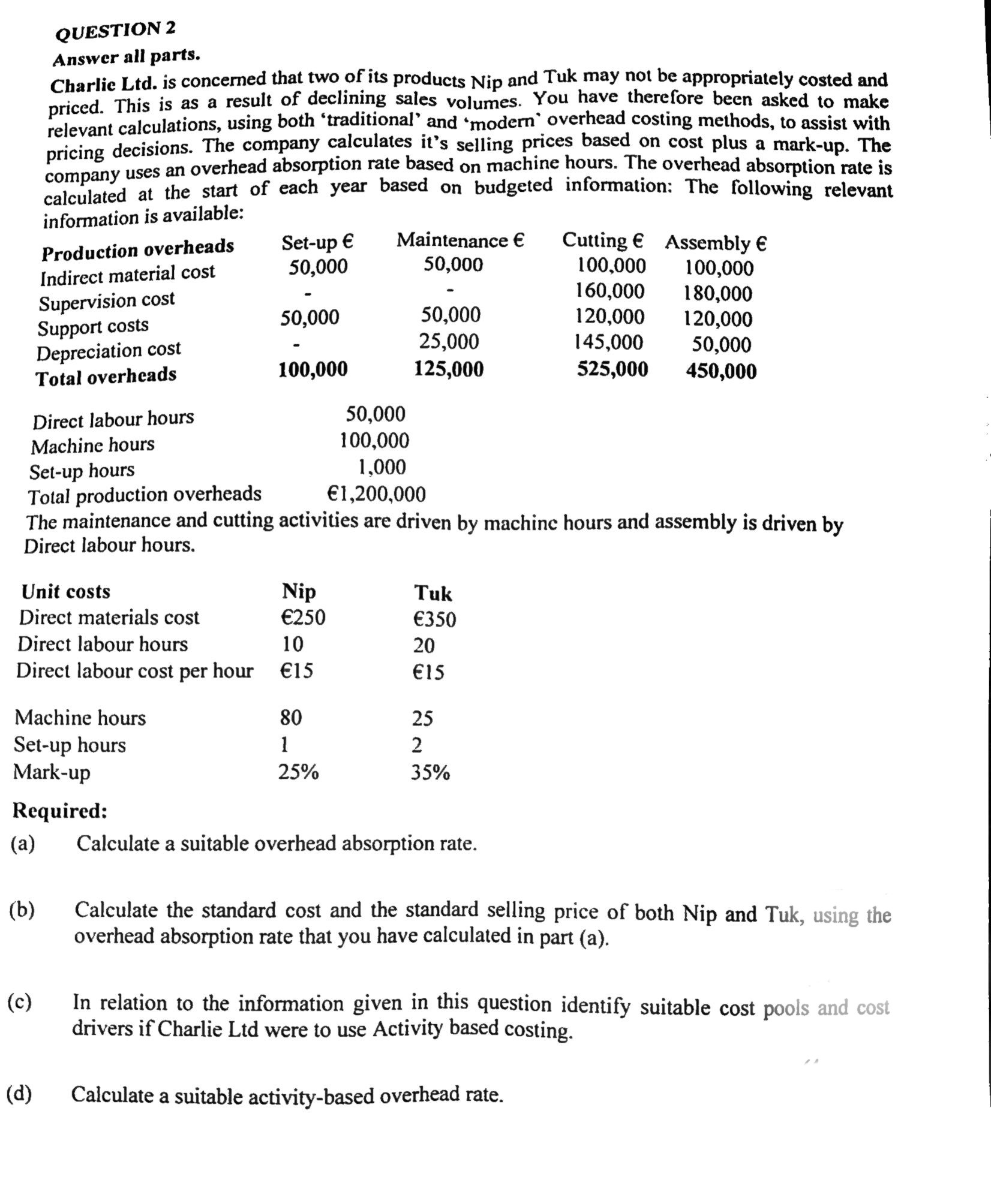

QUESTION 2 Answer all parts. Charlic Ltd. is concerned that two of its products Nip and Tuk may not be appropriately costed and priced. This is as a result of declining sales volumes. You have therefore been asked to make relevant calculations, using both 'traditional' and 'modern' overhead costing methods, to assist with pricing decisions. The company calculates it's selling prices based on cost plus a mark-up. The company uses an overhead absorption rate based on machine hours. The overhead absorption rate is calculated at the start of each year based on budgeted information: The following relevant information is available: The maintenance and cutting activities are driven by machinc hours and assembly is driven by Direct labour hours. Required: (a) Calculate a suitable overhead absorption rate. (b) Calculate the standard cost and the standard selling price of both Nip and Tuk, using the overhead absorption rate that you have calculated in part (a). (c) In relation to the information given in this question identify suitable cost pools and cost drivers if Charlie Ltd were to use Activity based costing. (d) Calculate a suitable activity-based overhead rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts