Question: Question 1: Are the negotiations issues Thomas identified correct? Why or Why not? Question 2: Thomas stated that his BATNA was the 2020 Honda CRV

Question 1: Are the negotiations issues Thomas identified correct? Why or Why not?

Question 2: Thomas stated that his BATNA was the 2020 Honda CRV Hybrid. Did he correctly identify his BATNA? Why or why not? (2 points)

Question 3: A very import strategy in negotiation is to develop and IMPROVE your BATNA. What could Thomas do to improve his BATNA?

Question 4: Thomas said that his reservation price would be the sticker price $32,985. Was it correct? Why or why not?

Question 5: What is anchoring bias? How does anchoring bias impact negotiations? Did Thomas fall into the anchoring bias in this negotiation? Why or why not?

Question 6: In this story, the financial manager brought up an additional issue of $500 additional financial charge to close the deal. What hardball technique was the financial manager using?

Question 7: Thomas stated that this negotiation was an integrative (win/win) negotiation. What are the major differences between distributive negotiation and integrative negotiation? Do you think Thomas car purchase negotiation was an integrative negotiation? Why or why not?

Question 8: What could Thomas do differently to get a better deal?

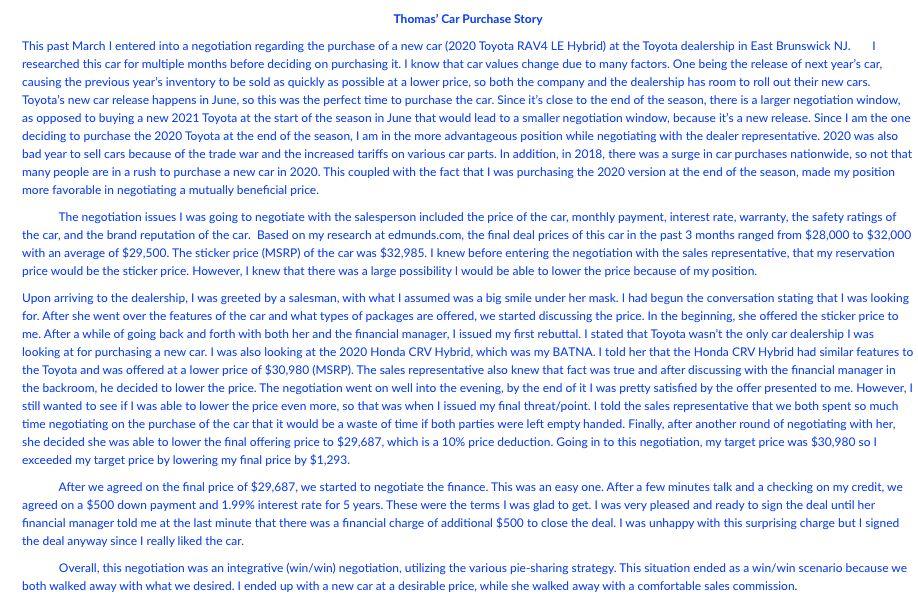

1 Thomas' Car Purchase Story This past March I entered into a negotiation regarding the purchase of a new car (2020 Toyota RAV4 LE Hybrid) at the Toyota dealership in East Brunswick NJ. researched this car for multiple months before deciding on purchasing it. I know that car values change due to many factors. One being the release of next year's car, causing the previous year's inventory to be sold as quickly as possible at a lower price, so both the company and the dealership has room to roll out their new cars. Toyota's new car release happens in June, so this was the perfect time to purchase the car. Since it's close to the end of the season, there is a larger negotiation window, as opposed to buying a new 2021 Toyota at the start of the season in June that would lead to a smaller negotiation window, because it's a new release. Since I am the one deciding to purchase the 2020 Toyota at the end of the season, I am in the more advantageous position while negotiating with the dealer representative. 2020 was also bad year to sell cars because of the trade war and the increased tariffs on various car parts. In addition, in 2018, there was a surge in car purchases nationwide, so not that many people are in a rush to purchase a new car in 2020. This coupled with the fact that I was purchasing the 2020 version at the end of the season, made my position more favorable in negotiating a mutually beneficial price. The negotiation issues I was going to negotiate with the salesperson included the price of the car, monthly payment, interest rate, warranty, the safety ratings of the car, and the brand reputation of the car. Based on my research at edmunds.com, the final deal prices of this car in the past 3 months ranged from $28,000 to $32,000 with an average of $29,500. The sticker price (MSRP) of the car was $32,985. I knew before entering the negotiation with the sales representative, that my reservation price would be the sticker price. However, I knew that there was a large possibility I would be able to lower the price because of my position. Upon arriving to the dealership, I was greeted by a salesman, with what I assumed was a big smile under her mask. I had begun the conversation stating that I was looking for. After she went over the features of the car and what types of packages are offered, we started discussing the price. In the beginning, she offered the sticker price to me. After a while of going back and forth with both her and the financial manager, I issued my first rebuttal. I stated that Toyota wasn't the only car dealership I was looking at for purchasing a new car. I was also looking at the 2020 Honda CRV Hybrid, which was my BATNA. I told her that the Honda CRV Hybrid had similar features to the Toyota and was offered at a lower price of $30,980 (MSRP). The sales representative also knew that fact was true and after discussing with the financial manager in the backroom, he decided to lower the price. The negotiation went on well into the evening, by the end of it I was pretty satisfied by the offer presented to me. However, I still wanted to see if I was able to lower the price even more, so that was when I issued my final threat/point. I told the sales representative that we both spent so much time negotiating on the purchase of the car that it would be a waste of time if both parties were left empty handed. Finally, after another round of negotiating with her, she decided she was able to lower the final offering price to $29,687, which is a 10% price deduction. Going in to this negotiation, my target price was $30,980 so! exceeded my target price by lowering my final price by $1,293. After we agreed on the final price of $29,687, we started to negotiate the finance. This was an easy one. After a few minutes talk and a checking on my credit, we agreed on a $500 down payment and 1.99% interest rate for 5 years. These were the terms I was glad to get. I was very pleased and ready to sign the deal until her financial manager told me at the last minute that there was a financial charge of additional $500 to close the deal. I was unhappy with this surprising charge but I signed the deal anyway since I really liked the car. Overall, this negotiation was an integrative (win/win) negotiation, utilizing the various pie-sharing strategy. This situation ended as a win/win scenario because we both walked away with what we desired. I ended up with a new car at a desirable price, while she walked away with a comfortable sales commissionStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts