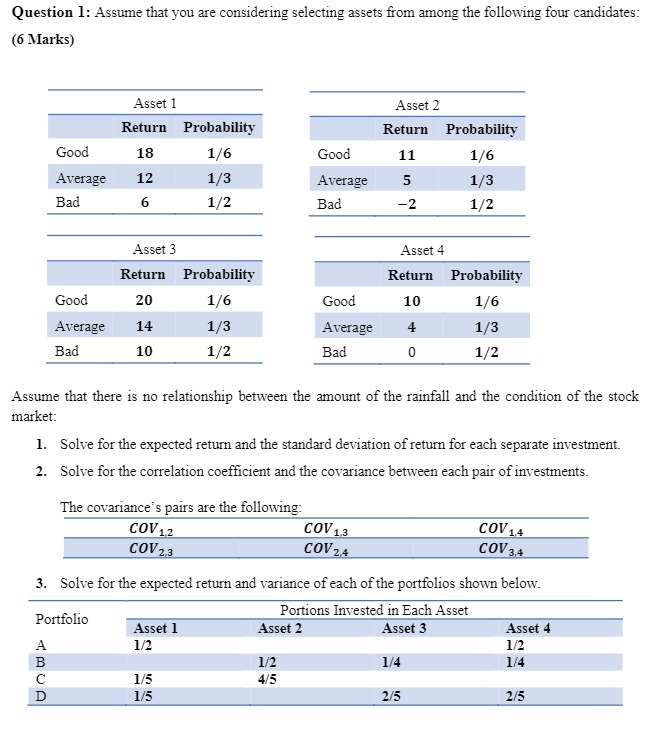

Question: Question 1: Assume that you are considering selecting assets from among the following four candidates: (6 Marks) Asset 1 Asset 2 Return Probability Return Probability

Question 1: Assume that you are considering selecting assets from among the following four candidates: (6 Marks) Asset 1 Asset 2 Return Probability Return Probability Good 18 1/6 Good 11 1/6 Average 12 1/3 Average 5 1/3 Bad 6 1/2 Bad -2 1/2 Asset 3 Asset 4 Return Probability Return Probability Good 20 1/6 Good 10 1/6 Average 14 1/3 Average 4 1/3 Bad 10 1/2 Bad 0 1/2 Assume that there is no relationship between the amount of the rainfall and the condition of the stock market: 1. Solve for the expected return and the standard deviation of return for each separate investment. 2. Solve for the correlation coefficient and the covariance between each pair of investments. The covariance's pairs are the following: COV12 COV 13 COV 14 COV23 COV 24 COV 3.4 3. Solve for the expected return and variance of each of the portfolios shown below. Portfolio Portions Invested in Each Asset Asset 1 Asset 2 Asset 3 Asset 4 A 1/2 1/2 B 1/2 1/4 1/4 1/5 4/5 1/5 2/5 2/5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts