Question: QUESTIONS AND PROBLEMS 1. Assume that you are considering selecting assets from among the following four candidates: Asset 1 Asset 2 Market Condition Market Condition

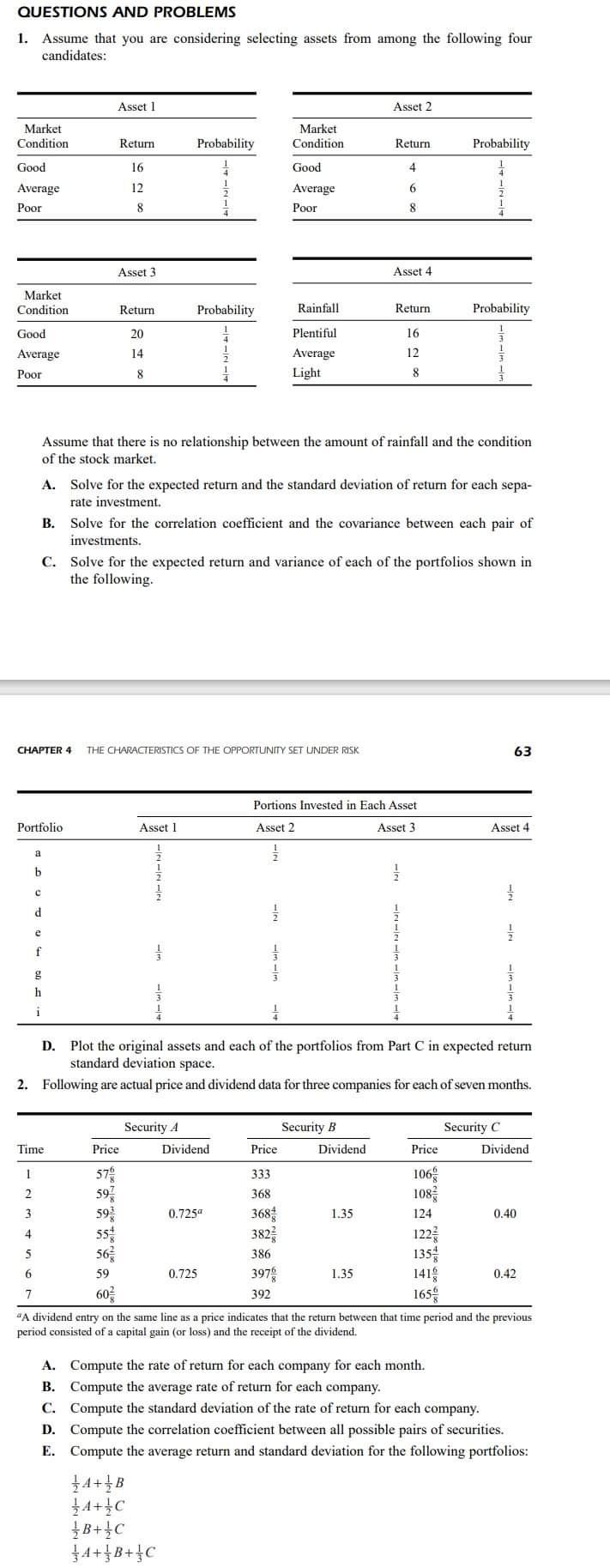

QUESTIONS AND PROBLEMS 1. Assume that you are considering selecting assets from among the following four candidates: Asset 1 Asset 2 Market Condition Market Condition Return Probability Return Probability Good 16 Good 4 Average 12 6 Average Poor Poor 8 8 Asset 3 Asset 4 Market Condition Return Probability Rainfall Return Probability Good 20 Plentiful 16 14 12 Average Poor Average Light 8 8 Assume that there is no relationship between the amount of rainfall and the condition of the stock market. A. Solve for the expected return and the standard deviation of return for each sepa- rate investment. B. Solve for the correlation coefficient and the covariance between each pair of investments. C. Solve for the expected return and variance of each of the portfolios shown in the following CHAPTER 4 THE CHARACTERISTICS OF PPORTUNITY SET UNDER RISK 63 Portions Invested in Each Asset Portfolio Asset 1 Asset 2 Asset 3 Asset 4 a b c d e f g h i D. Plot the original assets and each of the portfolios from Part C in expected return standard deviation space. 2. Following are actual price and dividend data for three companies for each of seven months. Security A Security B Security C Time Price Dividend Price Dividend Price Dividend 1 579 333 1065 2 597 368 108 3 593 0.7254 368 1.35 124 0.40 4 55 382 1223 5 56 386 135 6 59 0.725 3979 1.35 1413 0.42 7 603 392 165 "A dividend entry on the same line as a price indicates that the return between that time period and the previous period consisted of a capital gain (or loss) and the receipt of the dividend. A. Compute the rate of return for each company for each month. B. Compute the average rate of return for each company. C. Compute the standard deviation of the rate of return for each company. D. Compute the correlation coefficient between all possible pairs of securities. E. Compute the average return and standard deviation for the following portfolios: A+B {A+C {B+{C $4+1B+fc QUESTIONS AND PROBLEMS 1. Assume that you are considering selecting assets from among the following four candidates: Asset 1 Asset 2 Market Condition Market Condition Return Probability Return Probability Good 16 Good 4 Average 12 6 Average Poor Poor 8 8 Asset 3 Asset 4 Market Condition Return Probability Rainfall Return Probability Good 20 Plentiful 16 14 12 Average Poor Average Light 8 8 Assume that there is no relationship between the amount of rainfall and the condition of the stock market. A. Solve for the expected return and the standard deviation of return for each sepa- rate investment. B. Solve for the correlation coefficient and the covariance between each pair of investments. C. Solve for the expected return and variance of each of the portfolios shown in the following CHAPTER 4 THE CHARACTERISTICS OF PPORTUNITY SET UNDER RISK 63 Portions Invested in Each Asset Portfolio Asset 1 Asset 2 Asset 3 Asset 4 a b c d e f g h i D. Plot the original assets and each of the portfolios from Part C in expected return standard deviation space. 2. Following are actual price and dividend data for three companies for each of seven months. Security A Security B Security C Time Price Dividend Price Dividend Price Dividend 1 579 333 1065 2 597 368 108 3 593 0.7254 368 1.35 124 0.40 4 55 382 1223 5 56 386 135 6 59 0.725 3979 1.35 1413 0.42 7 603 392 165 "A dividend entry on the same line as a price indicates that the return between that time period and the previous period consisted of a capital gain (or loss) and the receipt of the dividend. A. Compute the rate of return for each company for each month. B. Compute the average rate of return for each company. C. Compute the standard deviation of the rate of return for each company. D. Compute the correlation coefficient between all possible pairs of securities. E. Compute the average return and standard deviation for the following portfolios: A+B {A+C {B+{C $4+1B+fc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts