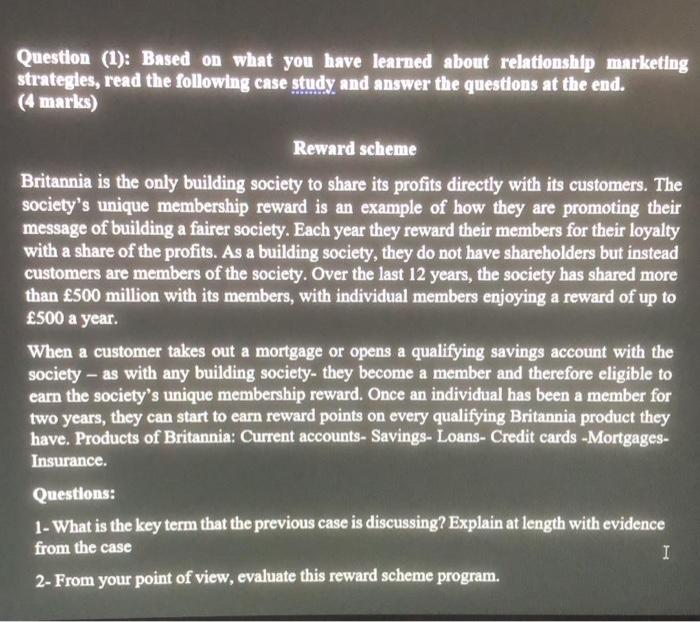

Question: Question (1): Based on what you have learned about relationship marketing strategies, read the following case study and answer the questions at the end. (4

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock