Question: Question 1 Consider a two - period binomial model for a non - dividend paying stock whose current price is S 0 = 1 0

Question

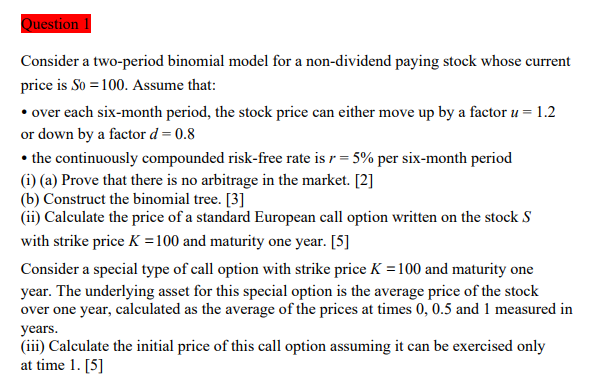

Consider a twoperiod binomial model for a nondividend paying stock whose current

price is Assume that:

over each sixmonth period, the stock price can either move up by a factor

or down by a factor

the continuously compounded riskfree rate is per sixmonth period

ia Prove that there is no arbitrage in the market.

b Construct the binomial tree.

ii Calculate the price of a standard European call option written on the stock

with strike price and maturity one year.

Consider a special type of call option with strike price and maturity one

year. The underlying asset for this special option is the average price of the stock

over one year, calculated as the average of the prices at times and measured in

years.

iii Calculate the initial price of this call option assuming it can be exercised only

at time

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock