Question: QUESTION 1 (DIFFICULT ROUND) PRACTICAL ACCOUNTING 1 On July 1, 1995, the Barcelona, Inc. issued P6,000,000 of 7% convertible bonds with interest payment dates of

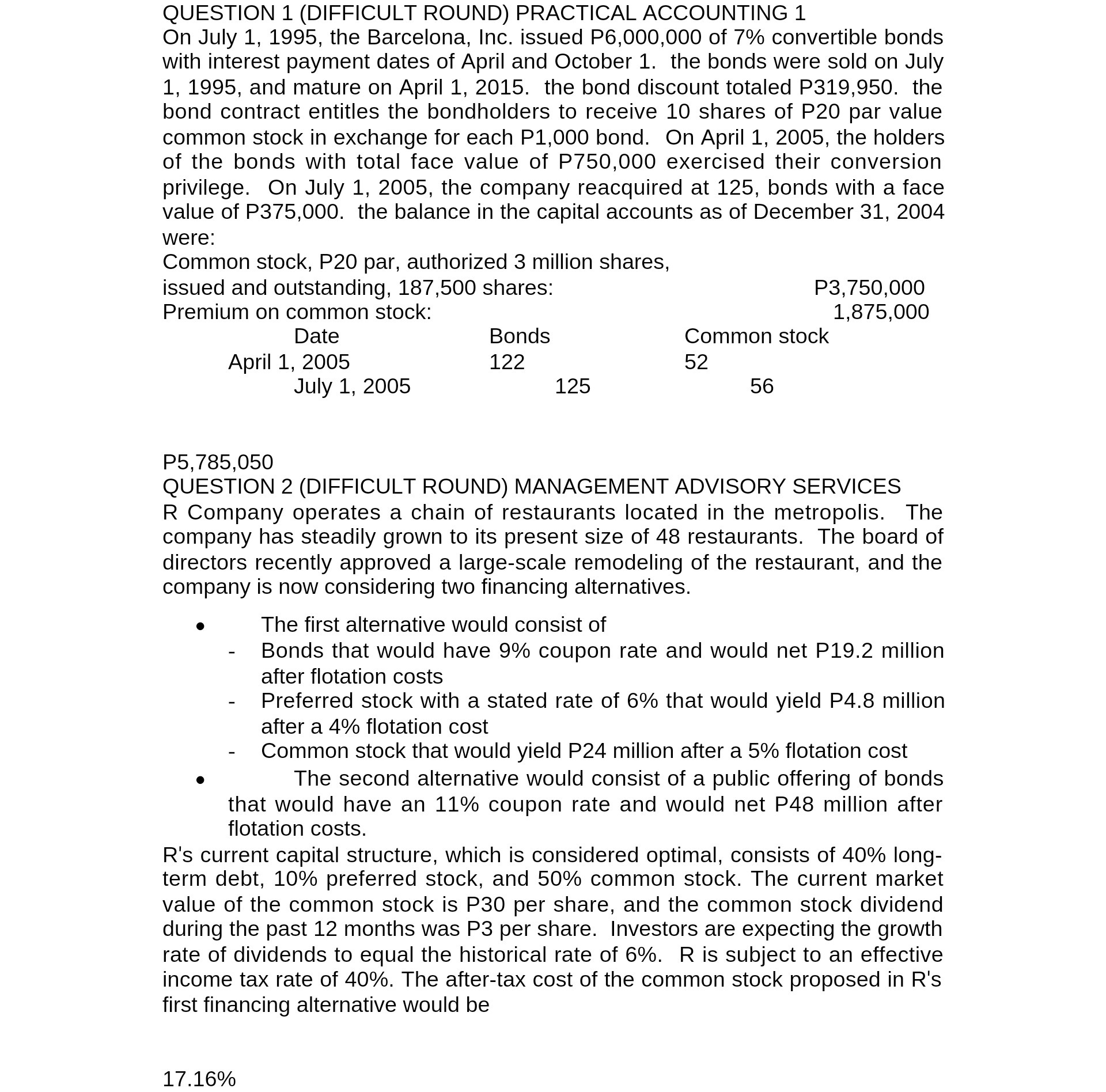

QUESTION 1 (DIFFICULT ROUND) PRACTICAL ACCOUNTING 1 On July 1, 1995, the Barcelona, Inc. issued P6,000,000 of 7% convertible bonds with interest payment dates of April and October 1. the bonds were sold on July 1, 1995, and mature on April 1, 2015. the bond discount totaled P319,950. the bond contract entitles the bondholders to receive 10 shares of P20 par value common stock in exchange for each P1,000 bond. On April 1, 2005, the holders of the bonds with total face value of P750,000 exercised their conversion privilege. On July 1, 2005, the company reacquired at 125, bonds with a face value of P375,000. the balance in the capital accounts as of December 31, 2004 were: Common stock, P20 par, authorized 3 million shares, issued and outstanding, 187,500 shares: P3,750,000 Premium on common stock: 1,875,000 Date Bonds Common stock April 1, 2005 122 52 July 1, 2005 125 56 P5,785,050 QUESTION 2 (DIFFICULT ROUND) MANAGEMENT ADVISORY SERVICES R Company operates a chain of restaurants located in the metropolis. The company has steadily grown to its present size of 48 restaurants. The board of directors recently approved a large-scale remodeling of the restaurant, and the company is now considering two financing alternatives. 0 The first alternative would consist of - Bonds that would have 9% coupon rate and would net P19.2 million after flotation costs - Preferred stock with a stated rate of 6% that would yield P4.8 million after a 4% flotation cost - Common stock that would yield P24 million after a 5% flotation cost a The second alternative would consist of a public offering of bonds that would have an 11% coupon rate and would net P48 million after flotation costs. R's current capital structure, which is considered optimal, consists of 40% long- term debt, 10% preferred stock, and 50% common stock. The current market value of the common stock is P30 per share, and the common stock dividend during the past 12 months was P3 per share. Investors are expecting the growth rate of dividends to equal the historical rate of 6%. R is subject to an effective income tax rate of 40%. The after-tax cost of the common stock proposed in R's first financing alternative would be 17.16%