Question: Question 1 marking guide (16 marks) Part a (i) (2 marks) Give a mark for indicating the diagram is drawn from Yolanda's perspective. Give a

|

a.

1+1+2+1+3+1+1=11

b.

2+1+2+1+2+1+1=11

c.

None of the other answers

d.

2+1+2+1+3+1+1=11

e.

2+1+2+1+3+1+1=12

f.

1+1+2+1+2+1+1=10

g.

2+1+2+1+3+1+1=12

h.

2+1+2+1+3+1+1=12

i.

2+1+2+1+3+1+1=12

j.

2+1+2+1+3+1+1=11

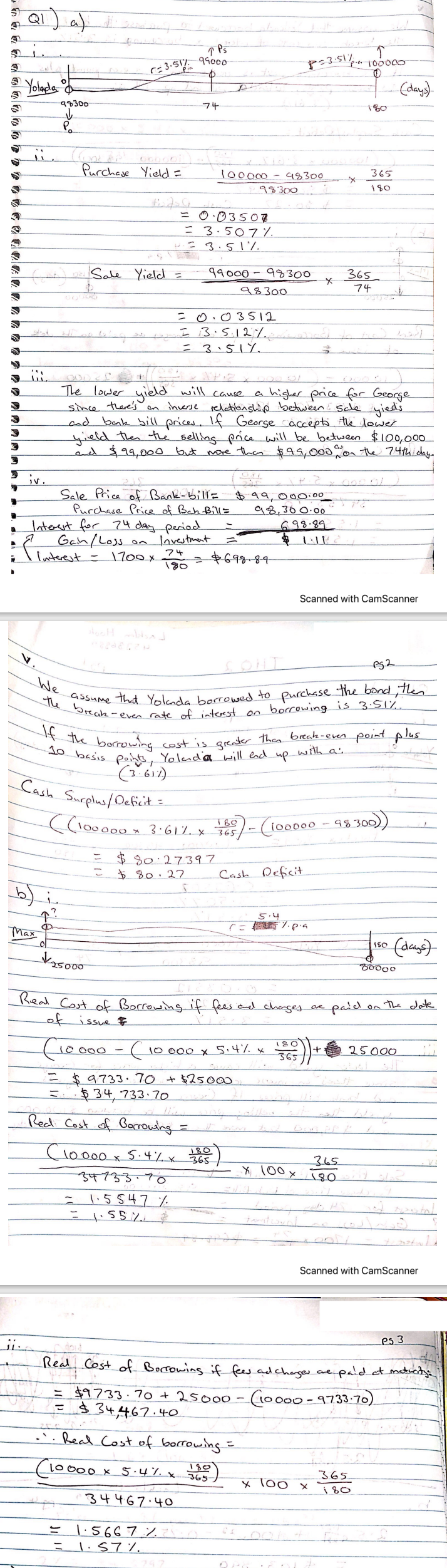

Q 1 a Ps 99000 p=3:51%. -3.51% O V DVD p100000 0 Yolanda (days)- 0 99300 V Po 74 Purchase Yield 100000 - 43300 99 300 X 365 190 = 0.03507 - 3.5077 3.51% or Sale Yield = 99000 - 99300 365 x 98300 74 - 03512 I 3.5.12% = 3.517. IN The lower yield will cause a higher price for George since there's an inverse relationship between Sale gieds and bank bill prices. If Georse accepts the lower yield then the selling price will be between $100,000 and $99,000 but more than $99,000 won the 74th day. iv. Sale Price of Bank-billa $99,000.00 Purchase Price of Bah Billa 98,360.00 Interest for 74 day period 698.89 Gain/Loss on Investment . Interest - 1700 x 24 = $698-84 190 Scanned with CamScanner 752 We assume the break-even rate of interest on borrowing is 3.51%. that Yolanda borrowed to purchase the bond, then If the borrowing cost is greater than break-even point plus with a 10 basis points, Yolada will end (3612) up Cash Surplus/ Deficit (100000 + 8300 300)) 3.612 x 1657- (100000 $ 80.27397 Cash Deficit $ 80.22 5.4 Buy pis Max o ka5000 (days) 8000 365 Real Cost of Borrowing if fees and charges are paid. on the date issue (10ooo - C 10000 x 5:47. * 25000 = $ 9733.70 + $2500 $ 34, 733.70 Real Cost of Borrowing = (10ooox 5.4% 65) 365 x 100 x 34733.70 180 - 1.5547 % 1.55% 2 180 x Scanned with CamScanner Ji es 3 Real Cost of Borrowing if fee and charges are paid at maturity = $9733.70 + 25000 - (10000 - 9733-70) = $34,467.40 ... Real Cost of borrowing (10000 x 5.4% x 108 ) 34467.40 ( 365 180 1.56672 1.577. Q 1 a Ps 99000 p=3:51%. -3.51% O V DVD p100000 0 Yolanda (days)- 0 99300 V Po 74 Purchase Yield 100000 - 43300 99 300 X 365 190 = 0.03507 - 3.5077 3.51% or Sale Yield = 99000 - 99300 365 x 98300 74 - 03512 I 3.5.12% = 3.517. IN The lower yield will cause a higher price for George since there's an inverse relationship between Sale gieds and bank bill prices. If Georse accepts the lower yield then the selling price will be between $100,000 and $99,000 but more than $99,000 won the 74th day. iv. Sale Price of Bank-billa $99,000.00 Purchase Price of Bah Billa 98,360.00 Interest for 74 day period 698.89 Gain/Loss on Investment . Interest - 1700 x 24 = $698-84 190 Scanned with CamScanner 752 We assume the break-even rate of interest on borrowing is 3.51%. that Yolanda borrowed to purchase the bond, then If the borrowing cost is greater than break-even point plus with a 10 basis points, Yolada will end (3612) up Cash Surplus/ Deficit (100000 + 8300 300)) 3.612 x 1657- (100000 $ 80.27397 Cash Deficit $ 80.22 5.4 Buy pis Max o ka5000 (days) 8000 365 Real Cost of Borrowing if fees and charges are paid. on the date issue (10ooo - C 10000 x 5:47. * 25000 = $ 9733.70 + $2500 $ 34, 733.70 Real Cost of Borrowing = (10ooox 5.4% 65) 365 x 100 x 34733.70 180 - 1.5547 % 1.55% 2 180 x Scanned with CamScanner Ji es 3 Real Cost of Borrowing if fee and charges are paid at maturity = $9733.70 + 25000 - (10000 - 9733-70) = $34,467.40 ... Real Cost of borrowing (10000 x 5.4% x 108 ) 34467.40 ( 365 180 1.56672 1.577

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts