Question: Question 1 Question 2 PLEASE GIVE ME A CALCULATION!!! The following table shows the initial balance sheet of a hypothetical bank. There are no reserves

Question 1

Question 2

PLEASE GIVE ME A CALCULATION!!!

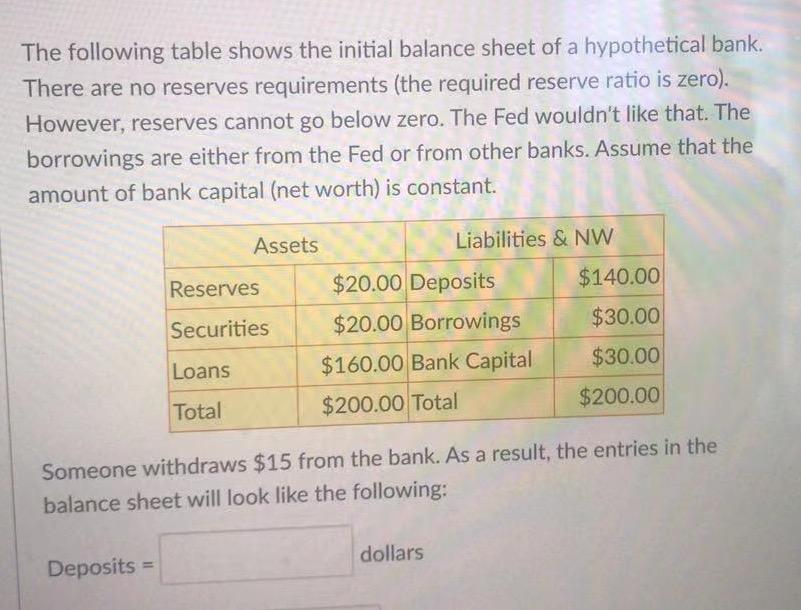

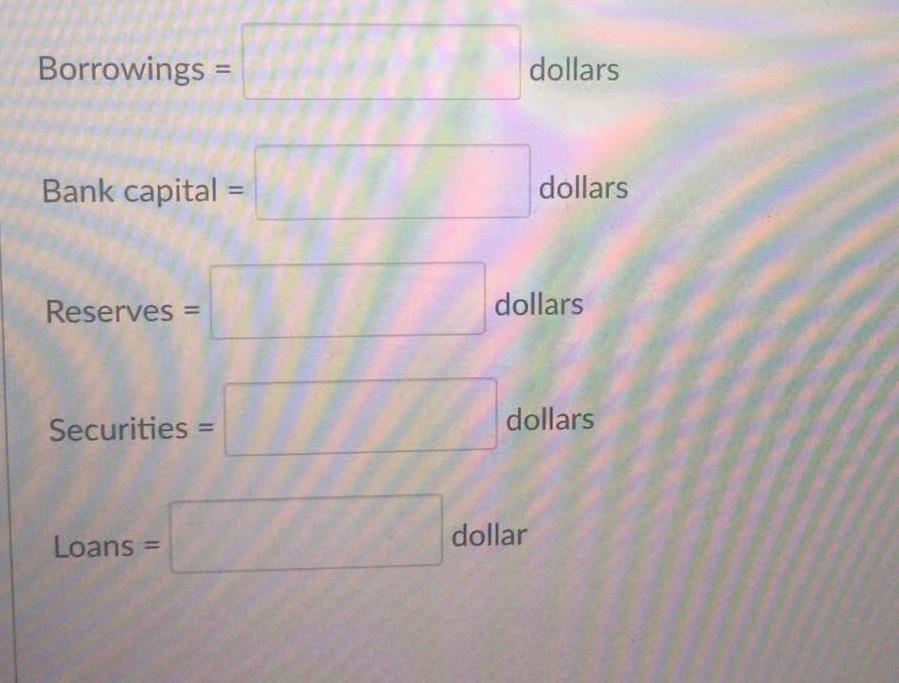

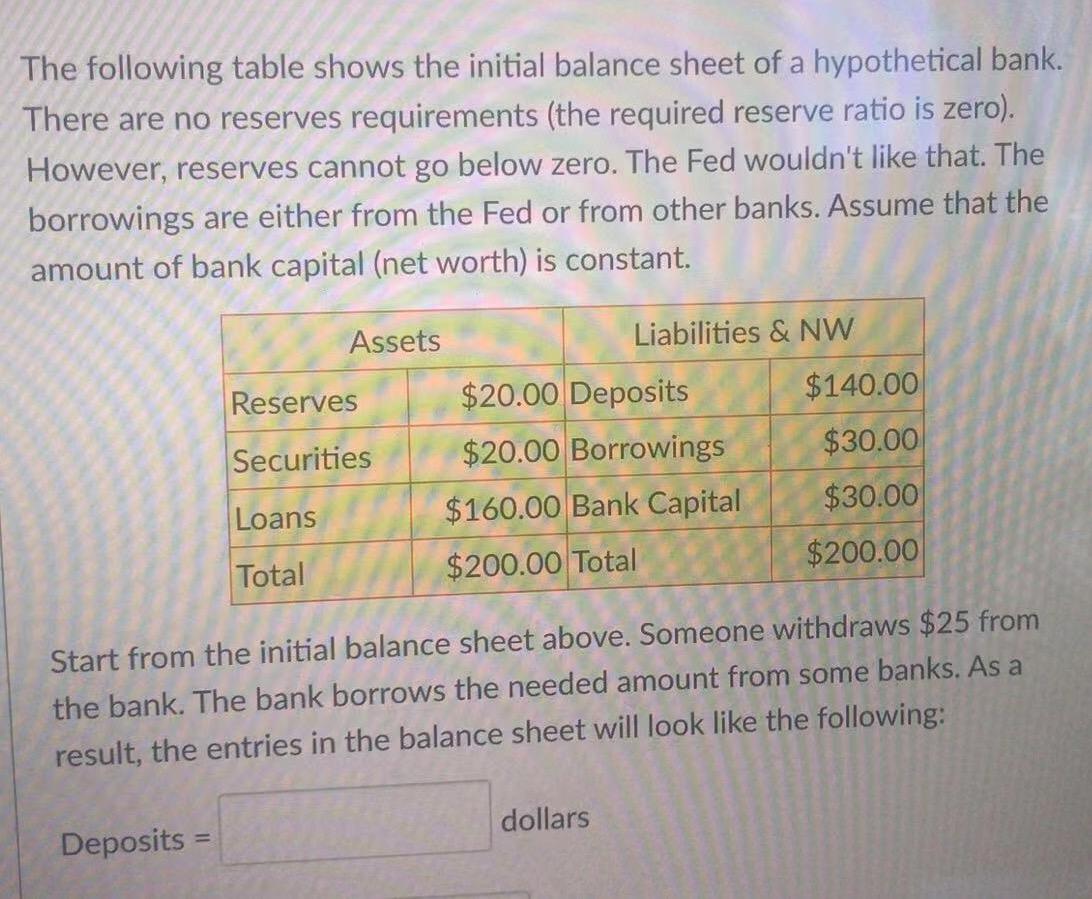

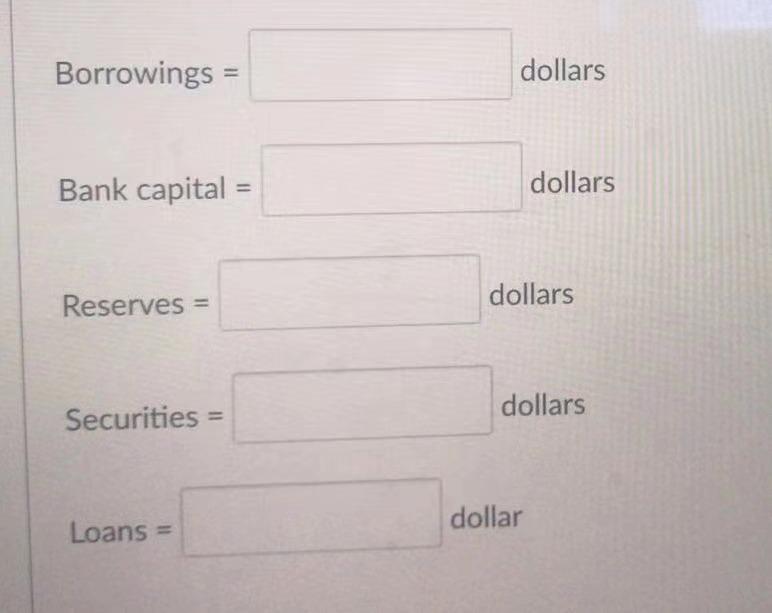

The following table shows the initial balance sheet of a hypothetical bank. There are no reserves requirements (the required reserve ratio is zero). However, reserves cannot go below zero. The Fed wouldn't like that. The borrowings are either from the Fed or from other banks. Assume that the amount of bank capital (net worth) is constant. Assets Liabilities & NW Reserves $20.00 Deposits $140.00 Securities $20.00 Borrowings $30.00 Loans $160.00 Bank Capital $30.00 Total $200.00 Total $200.00 Someone withdraws $15 from the bank. As a result, the entries in the balance sheet will look like the following: dollars Deposits = Borrowings = dollars Bank capital dollars Reserves = dollars Securities = dollars Loans = dollar The following table shows the initial balance sheet of a hypothetical bank. There are no reserves requirements (the required reserve ratio is zero). However, reserves cannot go below zero. The Fed wouldn't like that. The borrowings are either from the Fed or from other banks. Assume that the amount of bank capital (net worth) is constant. Assets Liabilities & NW Reserves Securities $20.00 Deposits $20.00 Borrowings $160.00 Bank Capital $200.00 Total $140.00 $30.00 $30.00 $200.00 Loans Total Start from the initial balance sheet above. Someone withdraws $25 from the bank. The bank borrows the needed amount from some banks. As a result, the entries in the balance sheet will look like the following: dollars Deposits = Borrowings = dollars Bank capital = dollars Reserves dollars = dollars Securities Loans = dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts