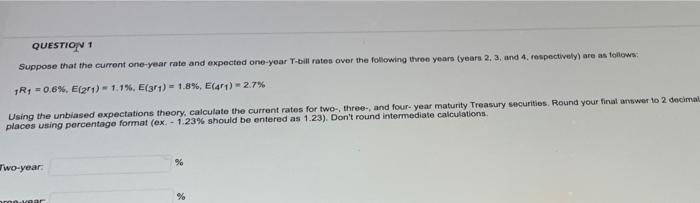

Question: QUESTION 1 Suppose that the current one-year rate and expected one-year T-bill rates over the following three years (years 2, 3, and 4, respectively) are

QUESTION 1 Suppose that the current one-year rate and expected one-year T-bill rates over the following three years (years 2, 3, and 4, respectively) are as follows: 1R4 =0.6%, E(201) - 1.1%, E(3:1) = 1.8%, EU) - 2.7% Using the unbiased expectations theory, calculate the current rates for two, three, and four-year maturity Treasury securities. Round your final awer 10 2 decimal places using percentage format (ex. - 1.23% should be entered as 1.23). Don't round intermediate calculations % wo-year var

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts