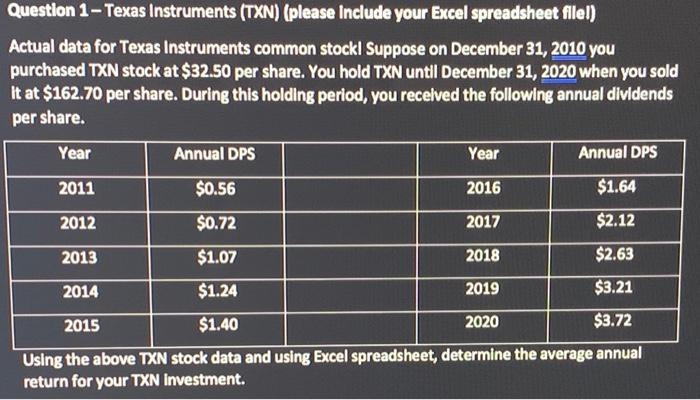

Question: Question 1 - Texas Instruments (TXN) (please Include your Excel spreadsheet filel) Actual data for Texas Instruments common stockl Suppose on December 31, 2010 you

Question 1 - Texas Instruments (TXN) (please Include your Excel spreadsheet filel) Actual data for Texas Instruments common stockl Suppose on December 31, 2010 you purchased TXN stock at $32.50 per share. You hold TXN until December 31, 2020 when you sold It at $162.70 per share. During this holding period, you recelved the following annual dividends per share. Year Annual DPS Year Annual DPS 2011 $0.56 2016 $1.64 2012 $0.72 2017 $2.12 2013 $1.07 2018 $2.63 2014 $1.24 2019 $3.21 2015 $1.40 2020 $3.72 Using the above TXN stock data and using Excel spreadsheet, determine the average annual return for your TXN Investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts