Question: Question 1 - Texas Instruments (TXN) (please include your Excel spreadsheet filel) Actual data for Texas Instruments common stockl Suppose on December 31, 2010 you

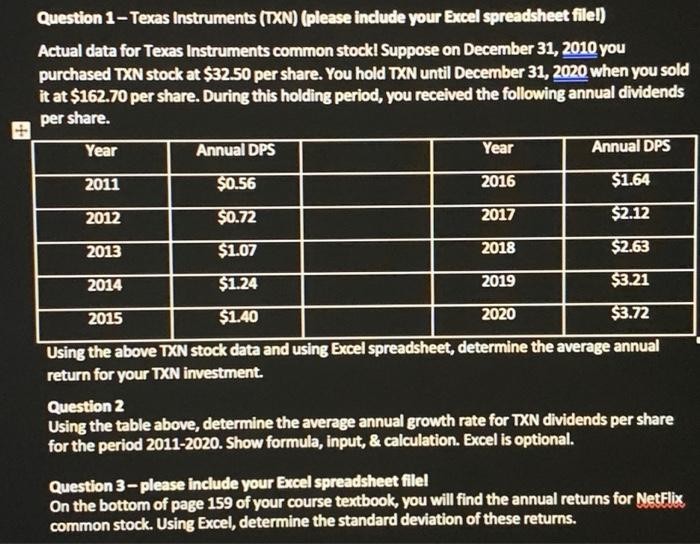

Question 1 - Texas Instruments (TXN) (please include your Excel spreadsheet filel) Actual data for Texas Instruments common stockl Suppose on December 31, 2010 you purchased TXN stock at $32.50 per share. You hold TXN until December 31, 2020 when you sold it at $162.70 per share. During this holding period, you received the following annual dividends per share. Year Annual DPS Year Annual DPS 2011 $0.56 2016 $1.64 2012 $0.72 2017 $2.12 2013 $1.07 2018 $2.63 2014 $1.24 2019 $3.21 2015 $1.40 2020 $3.72 Using the above TXN stock data and using Excel spreadsheet, determine the average annual return for your TXN investment. Question 2 Using the table above, determine the average annual growth rate for TXN dividends per share for the period 2011-2020. Show formula, input, & calculation. Excel is optional. Question 3- please include your Excel spreadsheet file! On the bottom of page 159 of your course textbook, you will find the annual returns for Netflix common stock. Using Excel, determine the standard deviation of these returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts