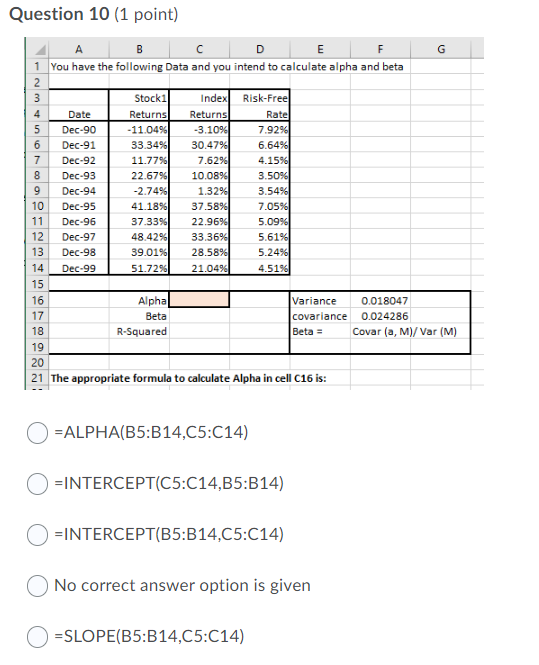

Question: Question 10 (1 point) co B D E F G 1 You have the following Data and you intend to calculate alpha and beta 2

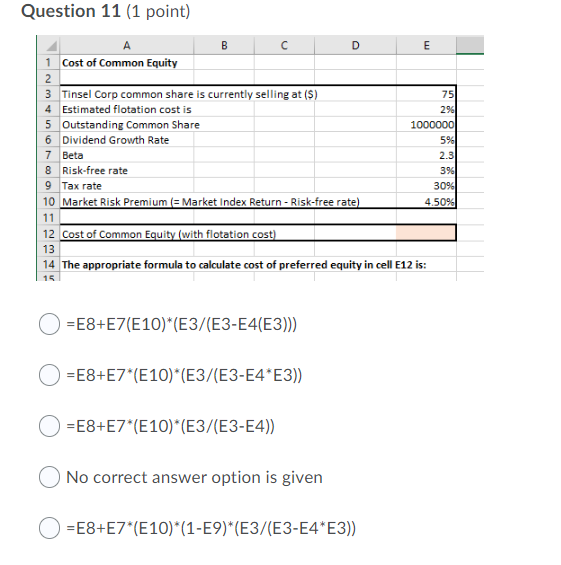

Question 10 (1 point) co B D E F G 1 You have the following Data and you intend to calculate alpha and beta 2 3 Stocki Index Risk-Free 4 Date Returns Returns Rate 5 Dec-90 -11.04% -3.10% 7.9296 6 Dec-91 33.34% 30.47% 6.64% 7 Dec-92 11.77% 7.62961 4.1596 8 Dec-93 22.6796 10.0896 3.50% 9 Dec-94 -2.74% 1.32% 3.54% 10 Dec-95 41.18% 37.5896 7.05% 11 Dec-96 37.33% 22.9696 5.0996 12 Dec-97 48.42% 33.36% 5.61% 13 Dec-98 39.01% 28.5896 5.24% 14 Dec-99 51.7296 21.0491 4.5196 15 16 Alpha Variance 0.018047 17 Beta covariance 0.024286 18 R-Squared Beta Covar (a, M)/Var (M) 19 20 21 The appropriate formula to calculate Alpha in cell C16 is: =ALPHA(B5:B14,C5:C14) =INTERCEPT(C5:C14,B5:B14) =INTERCEPT(B5:B14,C5:C14) No correct answer option is given =SLOPE(B5:B14,C5:C14) Question 11 (1 point) B D E 1 Cost of Common Equity 2 3 Tinsel Corp common share is currently selling at (S) 75 4 Estimated flotation cost is 296 5 Outstanding Common Share 10000001 6 Dividend Growth Rate 596 7 Beta 2.3 8 Risk-free rate 3961 9 Tax rate 30% 10 Market Risk Premium (= Market Index Return-Risk-free rate) 4.50% 11 12 Cost of Common Equity (with flotation cost) 13 14 The appropriate formula to calculate cost of preferred equity in cell E12 is: 15 =E8+E7(E10)*(E3/(E3-E4(E3))) =E8+E7*(E10)*(E3/(E3-E4*E3)) =E8+E7*(E10)*(E3/(E3-E4)) No correct answer option is given =E8+E7*(E10)*(1-E9)*(E3/(E3-E4*E3))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts