Question: Question 10 (10 points) A bond has a $1,000 par value, 18 years to maturity, and pays a coupon of 5.0% per year, semiannually. You

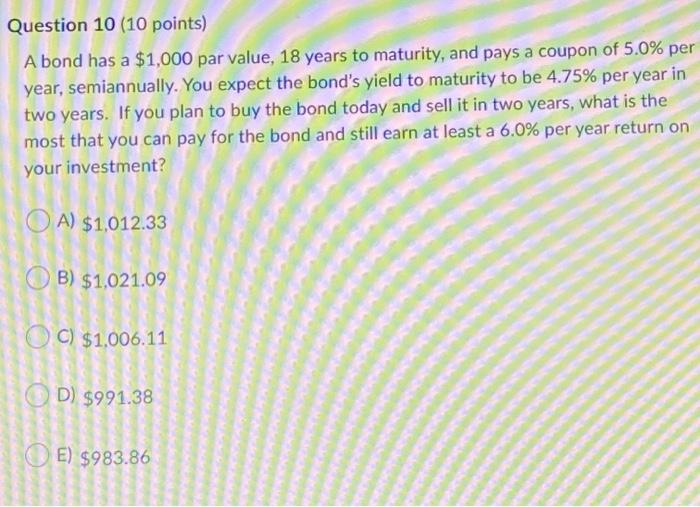

Question 10 (10 points) A bond has a $1,000 par value, 18 years to maturity, and pays a coupon of 5.0% per year, semiannually. You expect the bond's yield to maturity to be 4.75% per year in two years. If you plan to buy the bond today and sell it in two years, what is the most that you can pay for the bond and still earn at least a 6.0% per year return on your investment? A) $1,012.33 B) $1,021.09 OC) $1.006.11 D) $991.38 OE) $983.86

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock