Question: Question 10 5 points Save Answer You own a portfolio of corporate bonds. These bonds will pay the same coupon rate of 5K and have

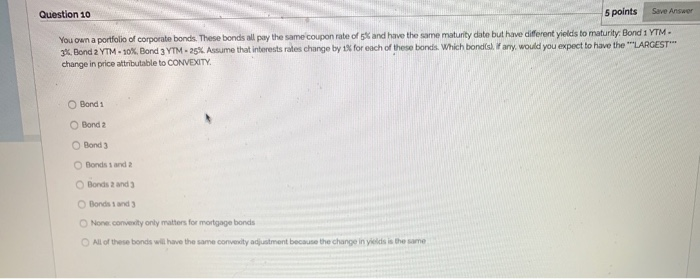

Question 10 5 points Save Answer You own a portfolio of corporate bonds. These bonds will pay the same coupon rate of 5K and have the same maturity date but have different yields to maturity. Bond 1 YTM 3. Bond 2 YTM - 10%, Bond 3 YTM - 25%. Assume that interest rates change by 1% for each of these bonds which bonds. Fany, would you expect to have the "LARGEST" change in price attributable to CONVEXITY. O Bond: O Bond 2 Bond 3 Bonds and 2 Bonds and Bonds and None convey only matters for mortgage bonds All of these bonds w ave the same con d iment because the change in die the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts