Question: QUESTION 10 Emily has a long position in a put option on a common stock with a strike price of $7.00. If the stock price

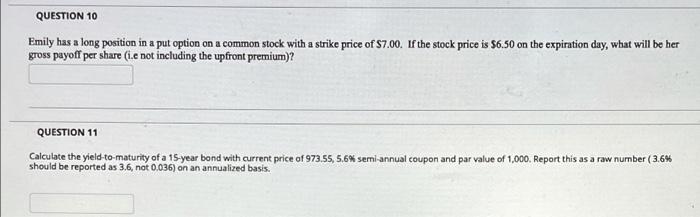

QUESTION 10 Emily has a long position in a put option on a common stock with a strike price of $7.00. If the stock price is $6.50 on the expiration day, what will be her gross payoff per share (i.e not including the upfront premium)? QUESTION 11 Calculate the yield-to-maturity of a 15-year bond with current price of 973.55, 5.6% semi-annual coupon and par value of 1,000. Report this as a raw number (3.6% should be reported as 3.6, not 0.036) on an annualized basis

Step by Step Solution

There are 3 Steps involved in it

Lets solve each question in detail QUESTION 10 Given Emily has a long position in a put option Strik... View full answer

Get step-by-step solutions from verified subject matter experts