Question: pls solve requirement a , b and c You have taken a long position in a call option on IBM common stock. The option has

pls solve requirement a , b and c

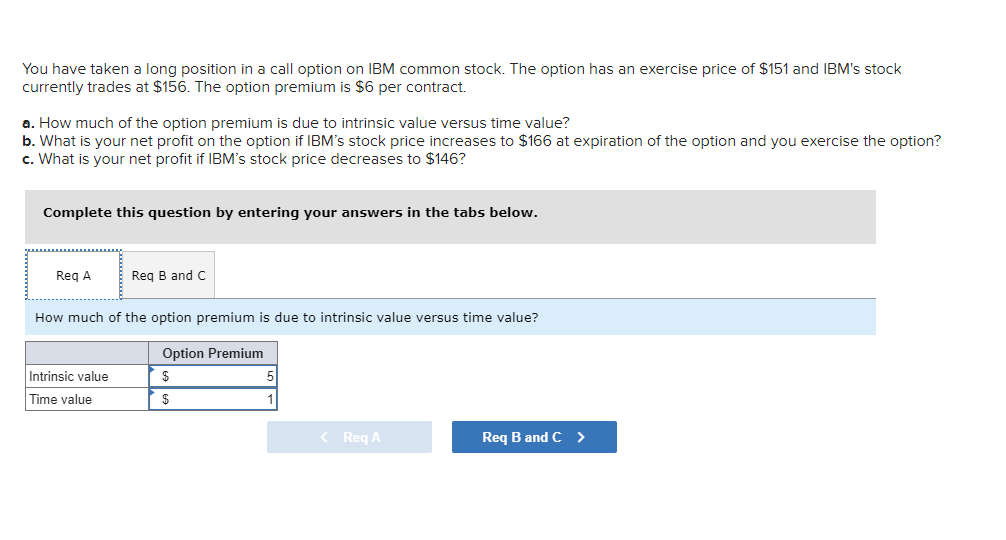

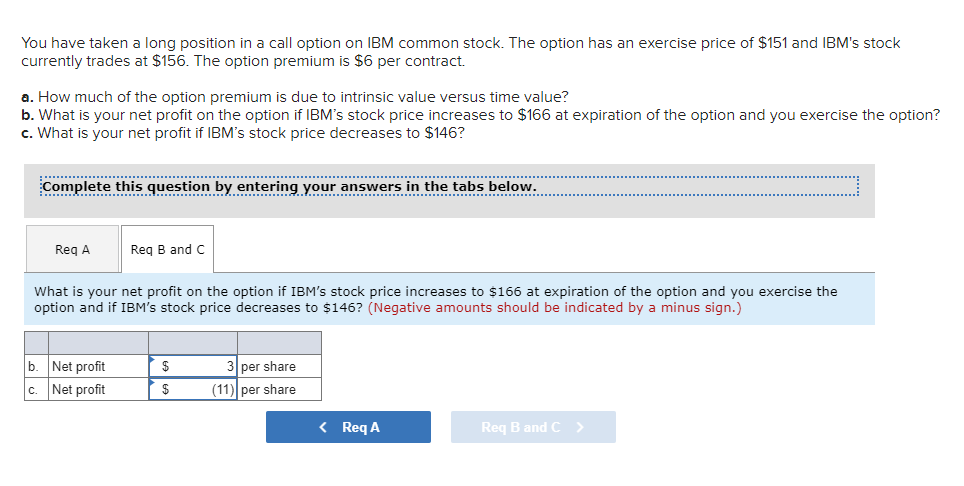

You have taken a long position in a call option on IBM common stock. The option has an exercise price of $151 and IBM's stock currently trades at $156. The option premium is $6 per contract. a. How much of the option premium is due to intrinsic value versus time value? b. What is your net profit on the option if IBM's stock price increases to $166 at expiration of the option and you exercise the option? c. What is your net profit if IBM's stock price decreases to $146? Complete this question by entering your answers in the tabs below. Reg A Req B and C How much of the option premium is due to intrinsic value versus time value? Option Premium Intrinsic value $ 5 Time value $ You have taken a long position in a call option on IBM common stock. The option has an exercise price of $151 and IBM's stock currently trades at $156. The option premium is $6 per contract. a. How much of the option premium is due to intrinsic value versus time value? b. What is your net profit on the option if IBM's stock price increases to $166 at expiration of the option and you exercise the option? c. What is your net profit if IBM's stock price decreases to $146? .......................................... Complete this question by entering your answers in the tabs below. Req A Reg B and C What is your net profit on the option if IBM's stock price increases to $166 at expiration of the option and you exercise the option and if IBM's stock price decreases to $146? (Negative amounts should be indicated by a minus sign.) $ b. Net profit c. Net profit 3 per share (11) per share $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts