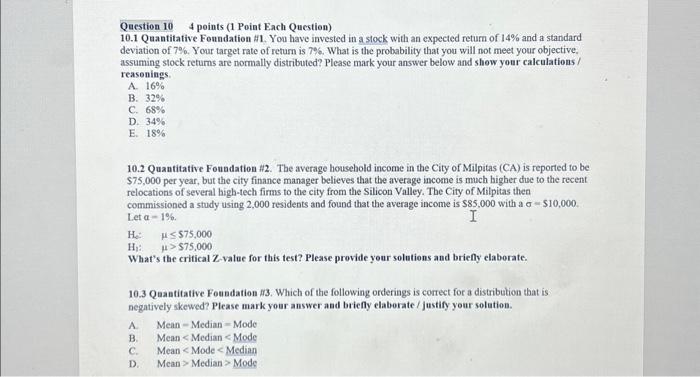

Question: Question 104 points (1 Point Each Question) 10.1 Quantitative Foundation H1. You have invested in a stock with an expected return of 14% and a

Question 104 points (1 Point Each Question) 10.1 Quantitative Foundation H1. You have invested in a stock with an expected return of 14% and a standard deviation of 7%. Your target rate of return is 7%. What is the probability that you will not meet your objective, assuming stock returns are normally distributed? Please mark your answer below and show your calculations / reasenings. A. 16% B. 32% C. 68% D. 34% E. 18% 10.2 Quantitative Foubdation #2. The average household income in the City of Milpitas (CA) is reported to be $75,000 per year, but the city finance manager believes that the average income is much higher due to the recent relocations of several bigh-tech firms to the city from the Silicon Valley. The City of Milpitas then commissioned a study using 2,000 residents and found that the average income is $85,000 with a =$10,000. Let =1%. H2:H1:575,000>$75,000 What's the critical Z value for this test? Please provide your solutions and briefly elaborate. 10.3 Quantitative Foubdation 13. Which of the following orderings is correct for a distribution that is negatively skewed? Please mark your answer and briefly elaborate / justify your solution. A. Mean - Median = Mode B. Mean Median > Mode

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts