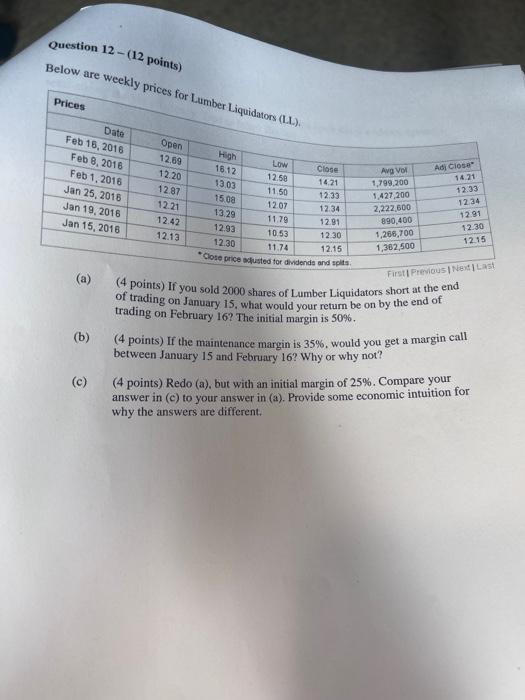

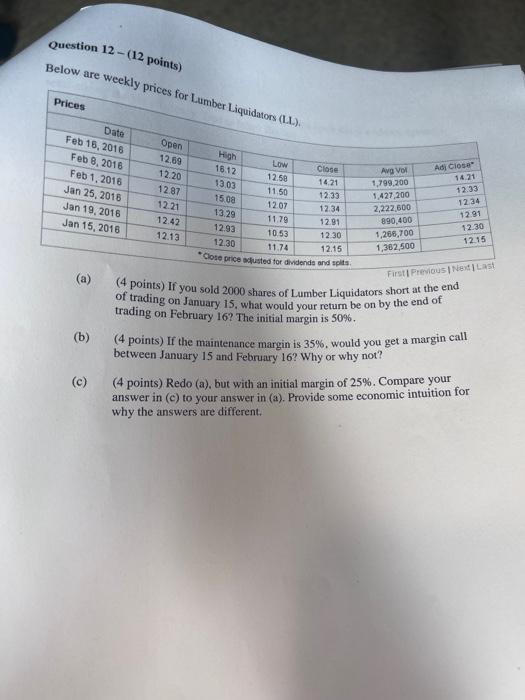

Question: Question 12- (12 points) Below are weekly prices for Lumber Liquidators (LL). Prices Date Feb 16, 2016 Feb 8, 2016 Feb 1, 2016 Jan 25,

Question 12- (12 points) Below are weekly prices for Lumber Liquidators (LL). Prices Date Feb 16, 2016 Feb 8, 2016 Feb 1, 2016 Jan 25, 2016 Jan 19, 2016 Jan 15, 2016 (a) (b) (c) Open 12.69 12.20 12.87 12.21 12.42 12.13 High 16.12 13.03 15.08 13.29 12.93 12.30 Low 12.58 11.50 12.07 11.79 10.53 11.74 *Close price adjusted for dividends and splits. Close 14.21 12.33 12.34 12.91 12.30 12.15 Avg Vol 1,799,200 1,427,200 2,222,600 890,400 1,266,700 1,362,500 Adj Close* 14.21 12.33 12.34 12.91 12.30 12.15 First | Previous | Next | Last (4 points) If you sold 2000 shares of Lumber Liquidators short at the end of trading on January 15, what would your return be on by the end of trading on February 16? The initial margin is 50%. (4 points) If the maintenance margin is 35%, would you get a margin call between January 15 and February 16? Why or why not? (4 points) Redo (a), but with an initial margin of 25%. Compare your answer in (c) to your answer in (a). Provide some economic intuition for why the answers are different.

Below are weekly prices for Lumber Liquidators (LL). (a) (4 points) If you sold 2000 shares of Lumber Liquidators short at the end of trading on January 15, what would your return be on by the end of trading on February 16? The initial margin is 50%. (b) (4 points) If the maintenance margin is 35%, would you get a margin call between January 15 and February 16 ? Why or why not? (c) (4 points) Redo (a), but with an initial margin of 25%. Compare your answer in (c) to your answer in (a). Provide some economic intuition for why the answers are different