Question: Question 12 (2 points) I have two risky assets A and B. Asset A's alpha is 2% and asset B's alpha is 3%. I should

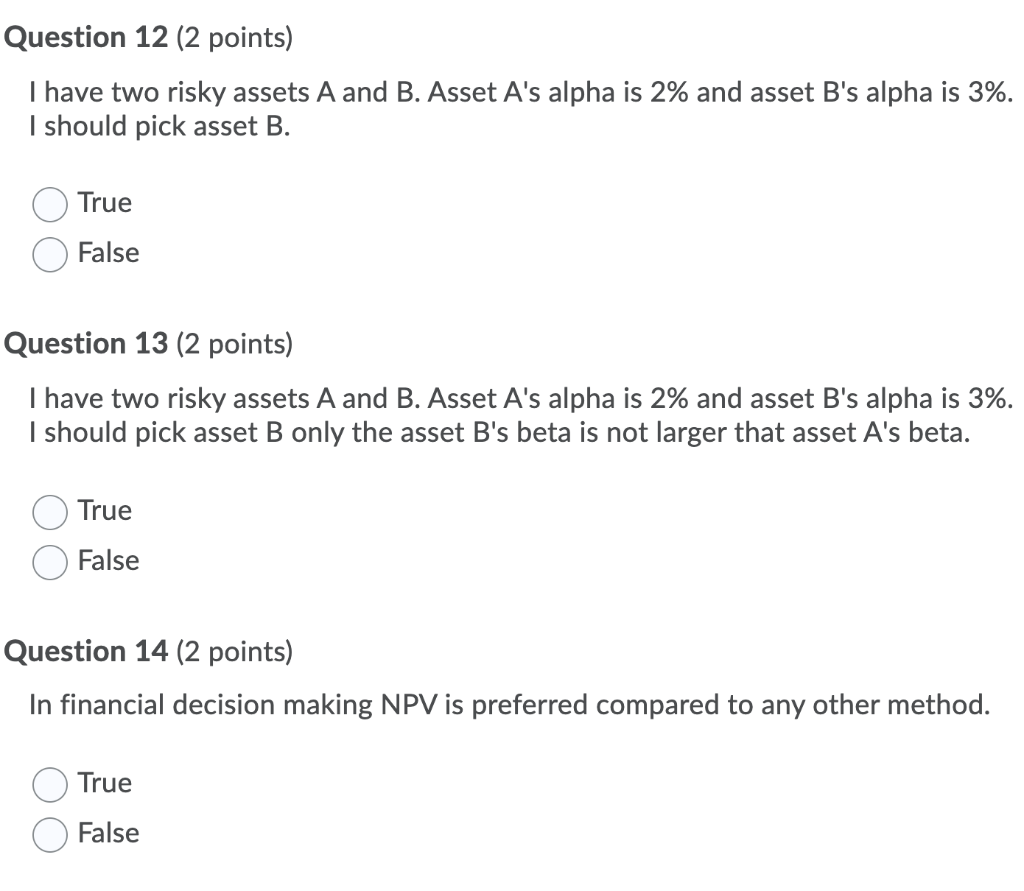

Question 12 (2 points) I have two risky assets A and B. Asset A's alpha is 2% and asset B's alpha is 3%. I should pick asset B. True False Question 13 (2 points) I have two risky assets A and B. Asset A's alpha is 2% and asset B's alpha is 3%. I should pick asset B only the asset B's beta is not larger that asset A's beta. True False Question 14 (2 points) In financial decision making NPV is preferred compared to any other method. True False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock