Question: Question 12 (5 points) 1. The expected return on the market portfolio is 15% and the risk-free rate of return is 6%. An investment has

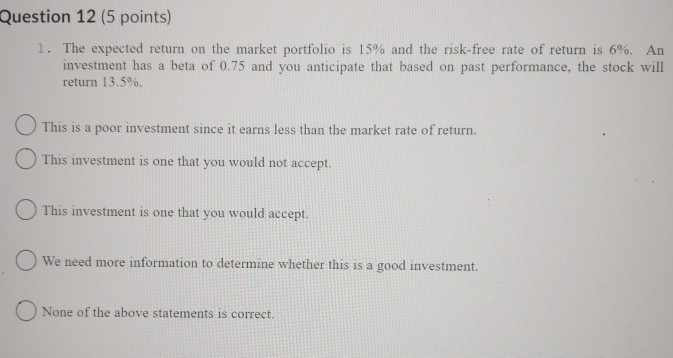

Question 12 (5 points) 1. The expected return on the market portfolio is 15% and the risk-free rate of return is 6%. An investment has a beta of 0.75 and you anticipate that based on past performance, the stock will return 13.5%. This is a poor investment since it earns less than the market rate of return This investment is one that you would not accept. This investment is one that you would accept. We need more information to determine whether this is a good investment. 0 None of the above statements is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts