Question: Question 12 a) A variable annuity, payable annually in arrears for n years, is such that the payment at the end of the year t

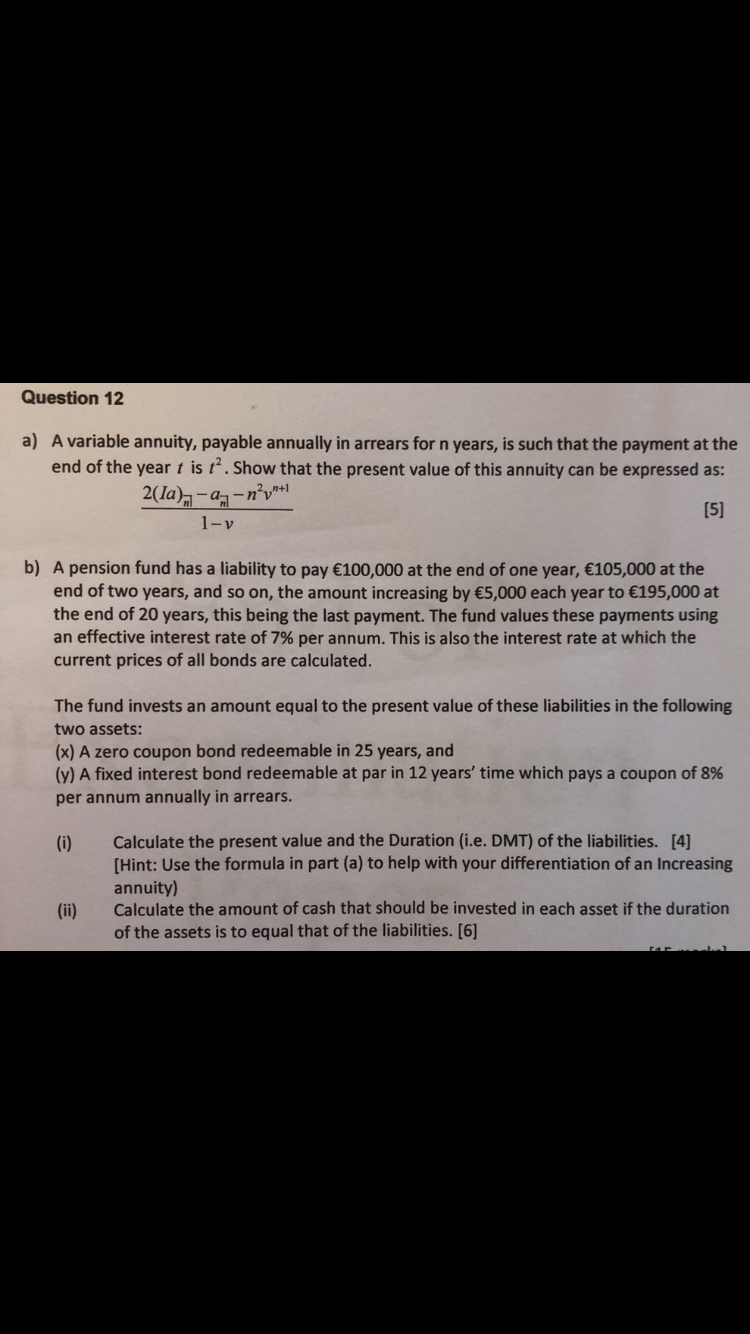

Question 12 a) A variable annuity, payable annually in arrears for n years, is such that the payment at the end of the year t is t. Show that the present value of this annuity can be expressed as: 2(lam-a-nv7+1 1-V [5] b) A pension fund has a liability to pay 100,000 at the end of one year, 105,000 at the end of two years, and so on, the amount increasing by 5,000 each year to 195,000 at the end of 20 years, this being the last payment. The fund values these payments using an effective interest rate of 7% per annum. This is also the interest rate at which the current prices of all bonds are calculated. The fund invests an amount equal to the present value of these liabilities in the following two assets: (x) A zero coupon bond redeemable in 25 years, and (y) A fixed interest bond redeemable at par in 12 years' time which pays a coupon of 8% per annum annually in arrears. (i) Calculate the present value and the Duration (i.e. DMT) of the liabilities. [4] (Hint: Use the formula in part (a) to help with your differentiation of an increasing annuity) Calculate the amount of cash that should be invested in each asset if the duration of the assets is to equal that of the liabilities. [6] (ii) Question 12 a) A variable annuity, payable annually in arrears for n years, is such that the payment at the end of the year t is t. Show that the present value of this annuity can be expressed as: 2(lam-a-nv7+1 1-V [5] b) A pension fund has a liability to pay 100,000 at the end of one year, 105,000 at the end of two years, and so on, the amount increasing by 5,000 each year to 195,000 at the end of 20 years, this being the last payment. The fund values these payments using an effective interest rate of 7% per annum. This is also the interest rate at which the current prices of all bonds are calculated. The fund invests an amount equal to the present value of these liabilities in the following two assets: (x) A zero coupon bond redeemable in 25 years, and (y) A fixed interest bond redeemable at par in 12 years' time which pays a coupon of 8% per annum annually in arrears. (i) Calculate the present value and the Duration (i.e. DMT) of the liabilities. [4] (Hint: Use the formula in part (a) to help with your differentiation of an increasing annuity) Calculate the amount of cash that should be invested in each asset if the duration of the assets is to equal that of the liabilities. [6] (ii)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts