Question: Question 13 (0.5 points) If D1 - $1.50, g (which is constant) = 6%, and PO = $56, what is the stock's expected capital gains

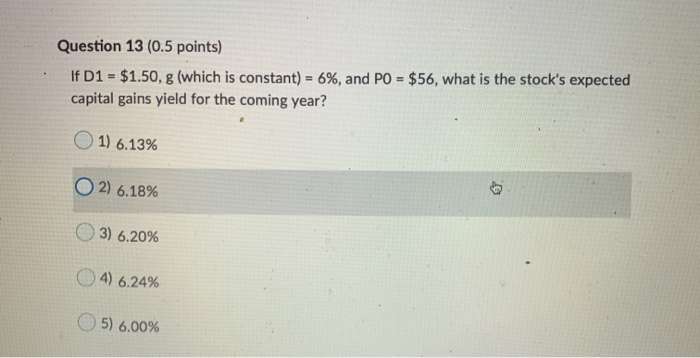

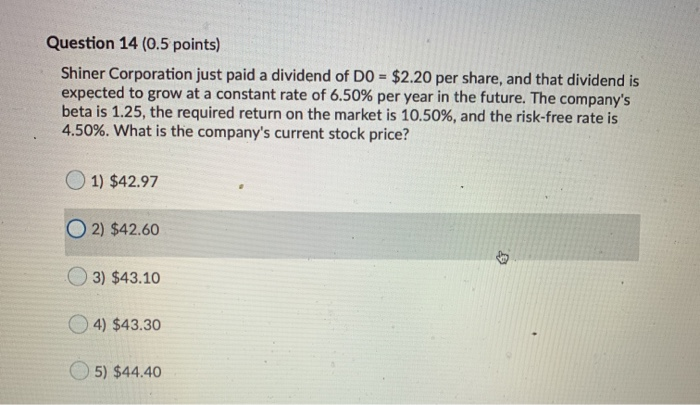

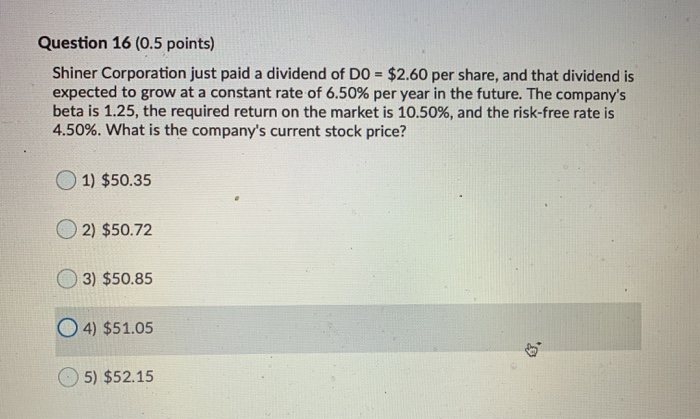

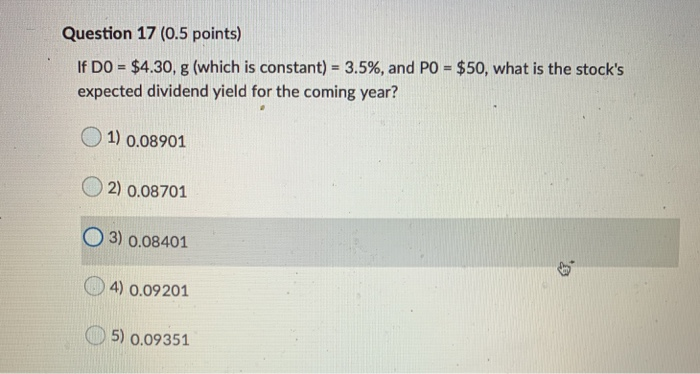

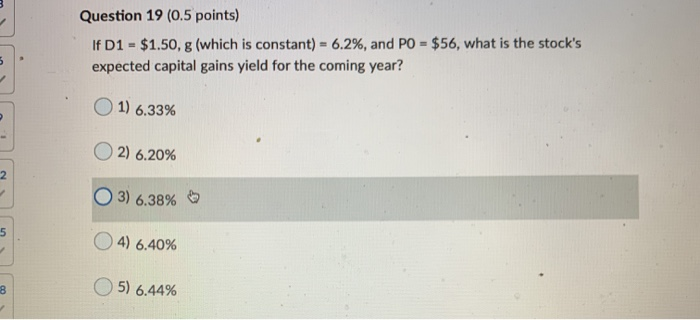

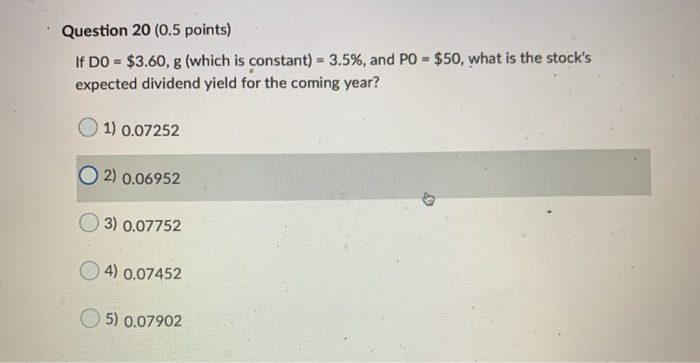

Question 13 (0.5 points) If D1 - $1.50, g (which is constant) = 6%, and PO = $56, what is the stock's expected capital gains yield for the coming year? 1) 6.13% O2) 6.18% 3) 6.20% 4) 6.24% 5) 6.00% Question 14 (0.5 points) Shiner Corporation just paid a dividend of DO = $2.20 per share, and that dividend is expected to grow at a constant rate of 6.50% per year in the future. The company's beta is 1.25, the required return on the market is 10.50%, and the risk-free rate is 4.50%. What is the company's current stock price? 1) $42.97 O2) $42.60 3) $43.10 4) $43.30 5) $44.40 Question 16 (0.5 points) Shiner Corporation just paid a dividend of DO = $2.60 per share, and that dividend is expected to grow at a constant rate of 6.50% per year in the future. The company's beta is 1.25, the required return on the market is 10.50%, and the risk-free rate is 4.50%. What is the company's current stock price? 1) $50.35 2) $50.72 3) $50.85 04) $51.05 5) $52.15 Question 17 (0.5 points) If DO = $4.30, g (which is constant) = 3.5%, and PO = $50, what is the stock's expected dividend yield for the coming year? 1) 0.08901 2) 0.08701 3) 0.08401 4) 0.09201 5) 0.09351 Question 19 (0.5 points) If D1 - $1.50, 8 (which is constant) = 6.2%, and PO = $56, what is the stock's expected capital gains yield for the coming year? 1) 6.33% 2) 6.20% 2 3) 6.38% 5 4) 6.40% 8 5) 6.44% Question 20 (0.5 points) If DO = $3.60, g (which is constant) = 3.5%, and PO - $50, what is the stock's expected dividend yield for the coming year? 1) 0.07252 O2) 0.06952 3) 0.07752 4) 0.07452 5) 0.07902

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts