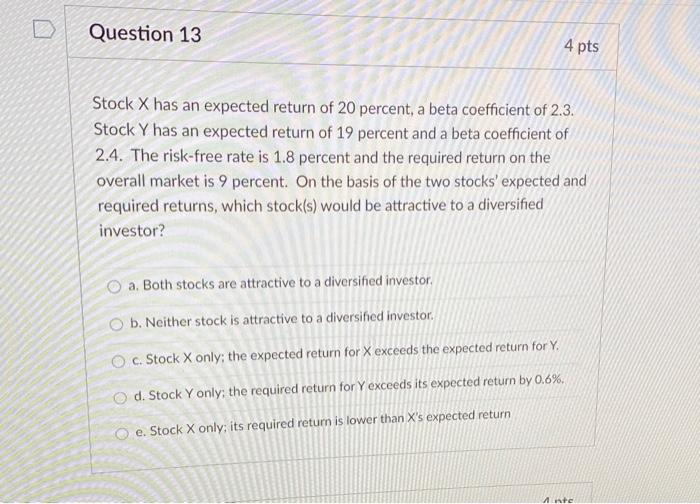

Question: Question 13 4 pts Stock X has an expected return of 20 percent, a beta coefficient of 2.3. Stock Y has an expected return of

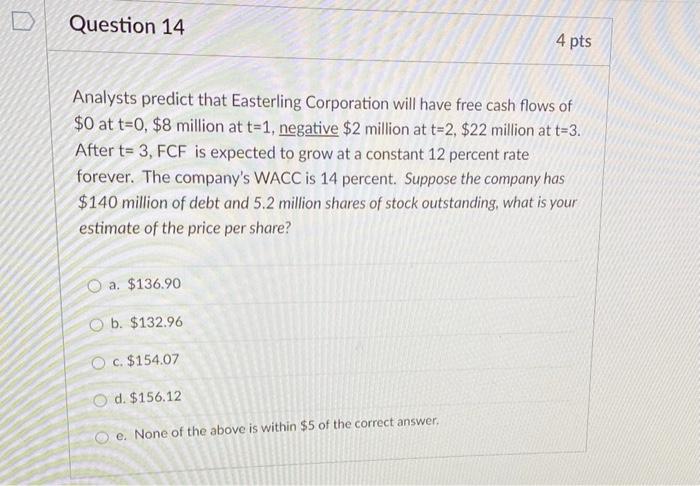

Question 13 4 pts Stock X has an expected return of 20 percent, a beta coefficient of 2.3. Stock Y has an expected return of 19 percent and a beta coefficient of 2.4. The risk-free rate is 1.8 percent and the required return on the overall market is 9 percent. On the basis of the two stocks' expected and required returns, which stock(s) would be attractive to a diversified investor? a. Both stocks are attractive to a diversified investor. b. Neither stock is attractive to a diversified investor. O c. Stock X only: the expected return for X exceeds the expected return for Y. d. Stock Yonly; the required return for Y exceeds its expected return by 0.6% O e. Stock X only; its required return is lower than X's expected return Ante Question 14 4 pts Analysts predict that Easterling Corporation will have free cash flows of $0 at t=0, $8 million at t=1, negative $2 million at t=2, $22 million at t=3. After t= 3, FCF is expected to grow at a constant 12 percent rate forever. The company's WACC is 14 percent. Suppose the company has $140 million of debt and 5.2 million shares of stock outstanding, what is your estimate of the price per share? O a. $136.90 O b. $132.96 O c. $154.07 O d. $156.12 e. None of the above is within $5 of the correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts