Question: question 13 is based on the information above! please show work. thanks Answer questions #10 - #15 based on the following information. We have a

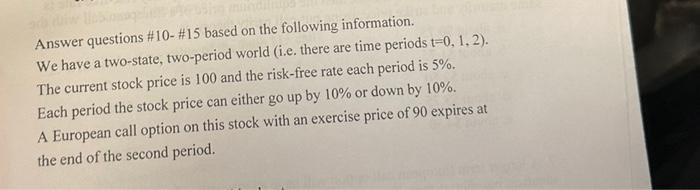

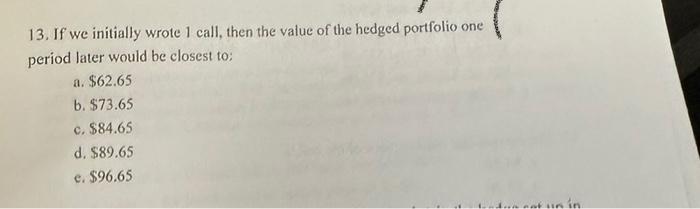

Answer questions #10 - \#15 based on the following information. We have a two-state, two-period world (i.e. there are time periods t=0,1,2 ). The current stock price is 100 and the risk-free rate each period is 5%. Each period the stock price can either go up by 10% or down by 10%. A European call option on this stock with an exercise price of 90 expires at the end of the second period. 13. If we initially wrote 1 call, then the value of the hedged portfolio one period later would be closest to: a. $62.65 b. $73.65 c. $84.65 d. $89.65 e. $96.65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts