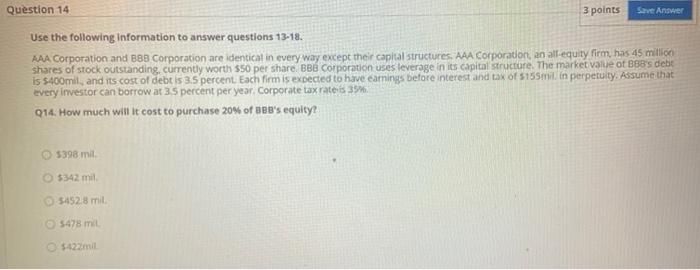

Question: Question 14 3 points Save Answer Use the following Information to answer questions 13-18. AAA Corporation and B88 Corporation are identical in every way except

Question 14 3 points Save Answer Use the following Information to answer questions 13-18. AAA Corporation and B88 Corporation are identical in every way except their capital structures. AAA Corporation, an all-equity firm has 45 million shares of stock outstanding, currently worth $50 per share. BB Corporation uses leverage in its capital structure. The market value of BBB's debt is $400mil, and its cost of debt is 3.5 percent. Each firm is expected to have earnings before interest and tax of 155mil in perpetuity. Assume that every investor can borrow at 35 percent per year. Corporate tax rates 39. 014. How much will it cost to purchase 20% of Bee's equity 5398 mil $342 mil 5452.8 mil 5478 mil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts