Question: Question lb OT 26 Question 16 3 points Save Answer Use the following information to answer questions 10-16. AAA Corporation and BBB Corporation are identical

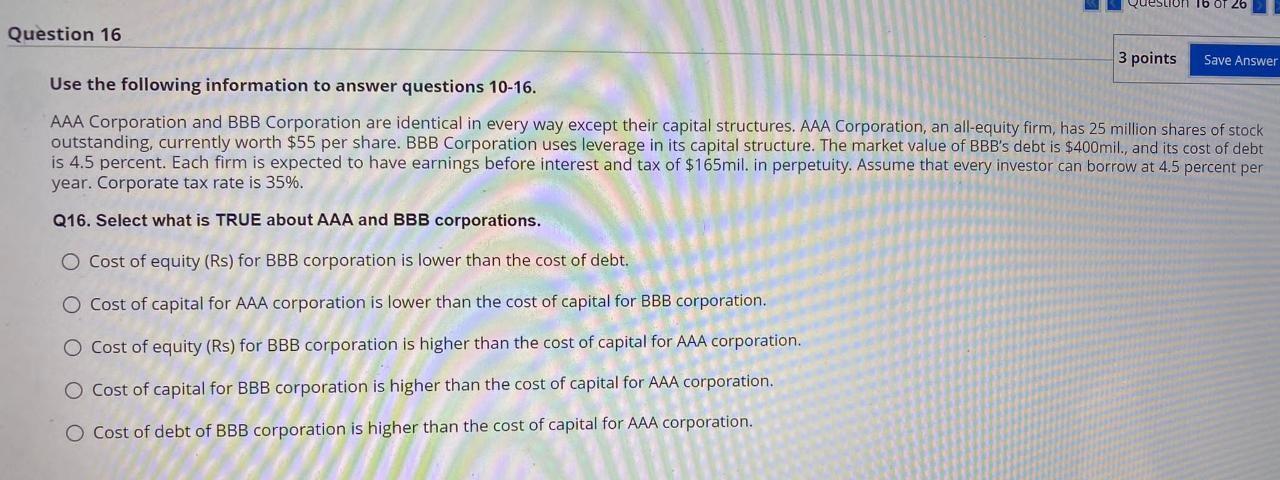

Question lb OT 26 Question 16 3 points Save Answer Use the following information to answer questions 10-16. AAA Corporation and BBB Corporation are identical in every way except their capital structures. AAA Corporation, an all-equity firm, has 25 million shares of stock outstanding, currently worth $55 per share. BBB Corporation uses leverage in its capital structure. The market value of BBB's debt is $400mil., and its cost of debt is 4.5 percent. Each firm is expected to have earnings before interest and tax of $165mil. in perpetuity. Assume that every investor can borrow at 4.5 percent per year. Corporate tax rate is 35%. Q16. Select what is TRUE about AAA and BBB corporations. O Cost of equity (Rs) for BBB corporation is lower than the cost of debt. O Cost of capital for AAA corporation is lower than the cost of capital for BBB corporation. O Cost of equity (Rs) for BBB corporation is higher than the cost of capital for AAA corporation. O Cost of capital for BBB corporation is higher than the cost of capital for AAA corporation. O Cost of debt of BBB corporation is higher than the cost of capital for AAA corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts