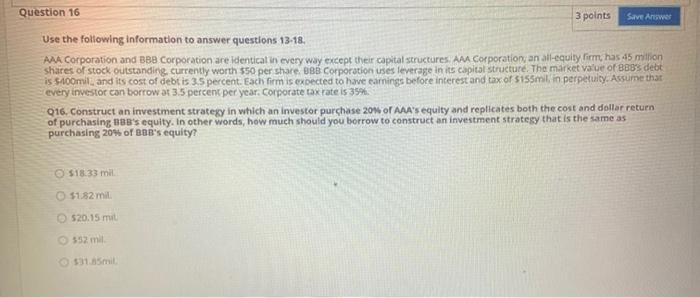

Question: Question 16 3 points Save Answer Use the following information to answer questions 13-18. AAA Corporation and BBB Corporation are identical in every way except

Question 16 3 points Save Answer Use the following information to answer questions 13-18. AAA Corporation and BBB Corporation are identical in every way except their capital structures. Am Corporation, an all-equity firm, has 45 milion shares of stock outstanding, currently worth 550 per shares Corporation uses leverage in its capital structure. The market value of 883% debt is $100mil and its cost of debt is 3.5 percent. Each firm is expected to have samnings before interest and tax of 3155mil in perpetuity. Assume that every investor can borrow at 3.5 percent per year. Corporate tax rate is 35 016. Construct an investment strategy in which an investor purchase 20 or AA's equity and replicates both the cost and dollar return of purchasing nab's equity. In other words, how much should you borrow to construct an investment strategy that is the same as purchasing 20% of Bob's equity $18.33 mil $1.82 mil 520.15 mil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts