Question: QUESTION 14 6 points Save Answer Liz has an arrangement with her broker to receive 2,500 shares of all available IPOs. The average IPO offer

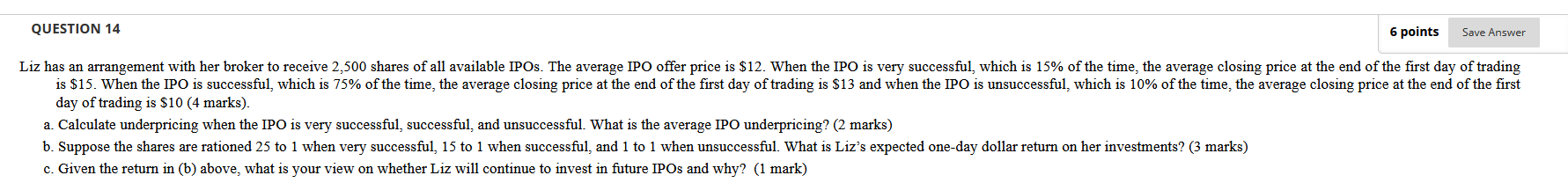

QUESTION 14 6 points Save Answer Liz has an arrangement with her broker to receive 2,500 shares of all available IPOs. The average IPO offer price is $12. When the IPO is very successful, which is 15% of the time, the average closing price at the end of the first day of trading is $15. When the IPO is successful, which is 75% of the time, the average closing price at the end of the first day of trading is $13 and when the IPO is unsuccessful, which is 10% of the time, the average closing price at the end of the first day of trading is $10 (4 marks). a. Calculate underpricing when the IPO is very successful, successful, and unsuccessful. What is the average IPO underpricing? (2 marks) b. Suppose the shares are rationed 25 to 1 when very successful, 15 to 1 when successful, and 1 to 1 when unsuccessful. What is Liz's expected one-day dollar return on her investments? (3 marks) c. Given the return in (b) above, what is your view on whether Liz will continue to invest in future IPOs and why? (1 mark) QUESTION 14 6 points Save Answer Liz has an arrangement with her broker to receive 2,500 shares of all available IPOs. The average IPO offer price is $12. When the IPO is very successful, which is 15% of the time, the average closing price at the end of the first day of trading is $15. When the IPO is successful, which is 75% of the time, the average closing price at the end of the first day of trading is $13 and when the IPO is unsuccessful, which is 10% of the time, the average closing price at the end of the first day of trading is $10 (4 marks). a. Calculate underpricing when the IPO is very successful, successful, and unsuccessful. What is the average IPO underpricing? (2 marks) b. Suppose the shares are rationed 25 to 1 when very successful, 15 to 1 when successful, and 1 to 1 when unsuccessful. What is Liz's expected one-day dollar return on her investments? (3 marks) c. Given the return in (b) above, what is your view on whether Liz will continue to invest in future IPOs and why? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts