Question: Question 14. Consider binomial model with So = 100, u = 1.2, d = .9 and r = .05. Use a three period (two step)

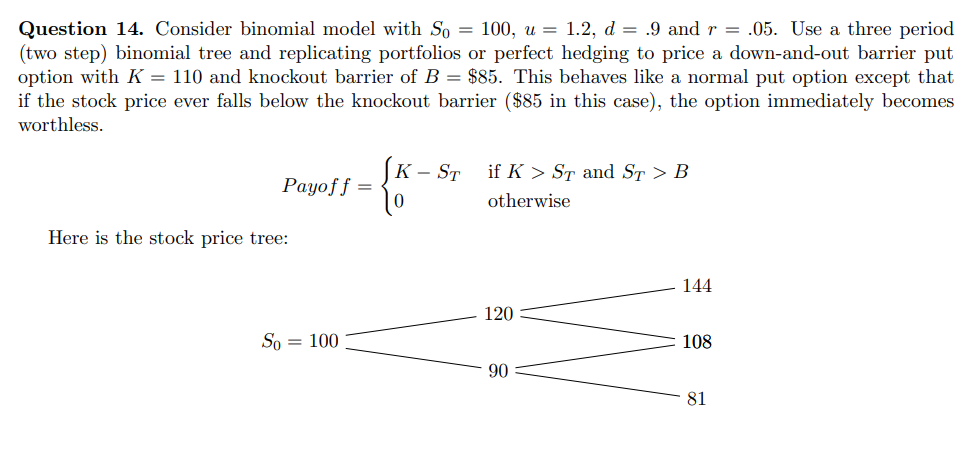

Question 14. Consider binomial model with So = 100, u = 1.2, d = .9 and r = .05. Use a three period (two step) binomial tree and replicating portfolios or perfect hedging to price a down-and-out barrier put option with K = 110 and knockout barrier of B = $85. This behaves like a normal put option except that if the stock price ever falls below the knockout barrier ($85 in this case), the option immediately becomes worthless. SK ST Payoff = if K > ST and ST > B otherwise Here is the stock price tree: 144 120 So = 100 108 90 81

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts