Question: Question 1(6 +4 = 10 marks) A) You are the finance manager of Z&Z co. The company is currently considering some new strategies for managing

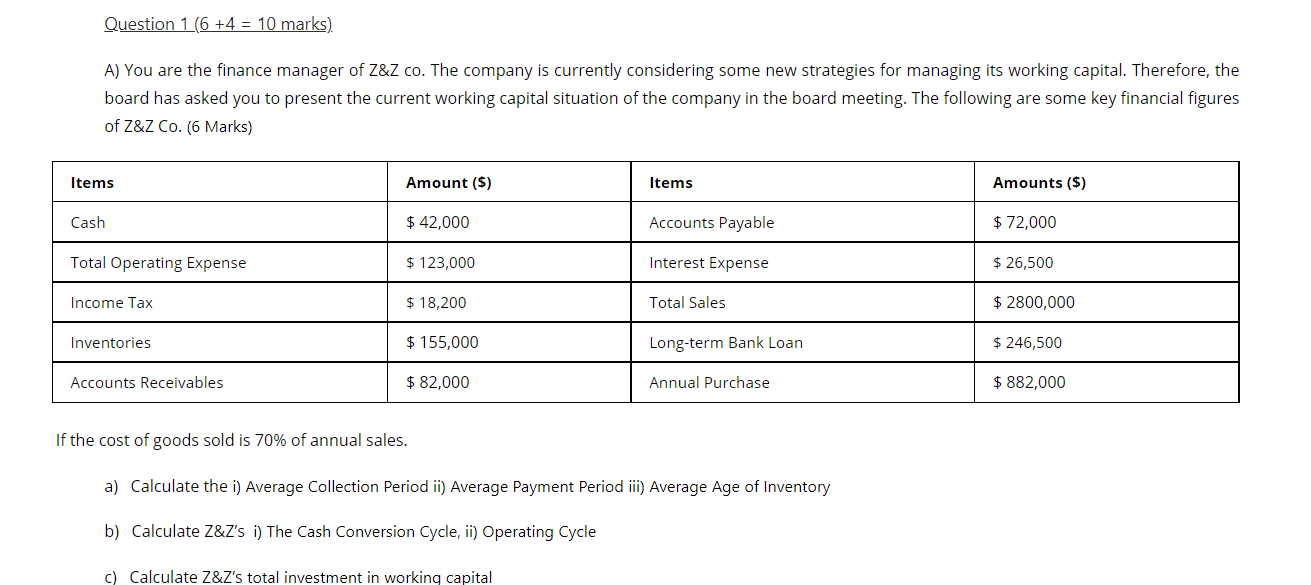

Question 1(6 +4 = 10 marks) A) You are the finance manager of Z&Z co. The company is currently considering some new strategies for managing its working capital. Therefore, the board has asked you to present the current working capital situation of the company in the board meeting. The following are some key financial figures of Z&Z Co. (6 Marks) Items Amount ($) Items Amounts ($) Cash $ 42,000 Accounts Payable $ 72,000 Total Operating Expense $ 123,000 Interest Expense $ 26,500 Income Tax $ 18,200 Total Sales $ 2800,000 Inventories $ 155,000 Long-term Bank Loan $ 246,500 Accounts Receivables $ 82,000 Annual Purchase $ 882,000 If the cost of goods sold is 70% of annual sales. a) Calculate the i) Average Collection Period ii) Average Payment Period iii) Average Age of Inventory b) Calculate Z&Z's i) The Cash Conversion Cycle, ii) Operating Cycle c) Calculate Z&Z's total investment in working capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts