Question: QUESTION 16 The table below provides the ring perhe value for Tyler, never the past seven years. With 12 will shares year (2000) is percent

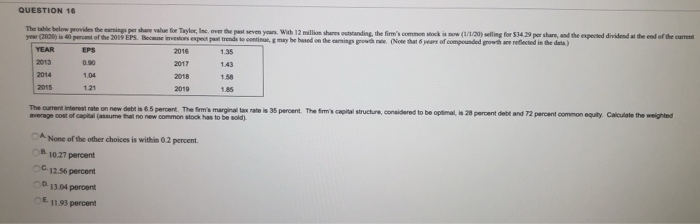

QUESTION 16 The table below provides the ring perhe value for Tyler, never the past seven years. With 12 will shares year (2000) is percent of the 2010 P lecane e spe r ando con may based on the m wanting the firm's comme Mock is sw (1/1/2)selling for 534 29 pershand the expected divided at the end of the current o uth that years of compounded growth reflected in the data) The current rest rate on new dat is 65 percent. The firm's marginal tax rate is 35 percent. The firm's capital structure, considered to be optimalis 20 percent debt and 72 percent common equity. Calculate the weighted average cost of capital assume that no new common stock has to be sold). A Nose of the other choices is within 2 percent. 10 27 percent 6 percent 13.4 percent 11.9 percent QUESTION 16 The table below provides the ring perhe value for Tyler, never the past seven years. With 12 will shares year (2000) is percent of the 2010 P lecane e spe r ando con may based on the m wanting the firm's comme Mock is sw (1/1/2)selling for 534 29 pershand the expected divided at the end of the current o uth that years of compounded growth reflected in the data) The current rest rate on new dat is 65 percent. The firm's marginal tax rate is 35 percent. The firm's capital structure, considered to be optimalis 20 percent debt and 72 percent common equity. Calculate the weighted average cost of capital assume that no new common stock has to be sold). A Nose of the other choices is within 2 percent. 10 27 percent 6 percent 13.4 percent 11.9 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts