Question: Question 18 Borderless World Berhad is evaluating two mutually exclusive capital budgeting projects. Both projects require the same amount of initial outlay totalling RM15 million.

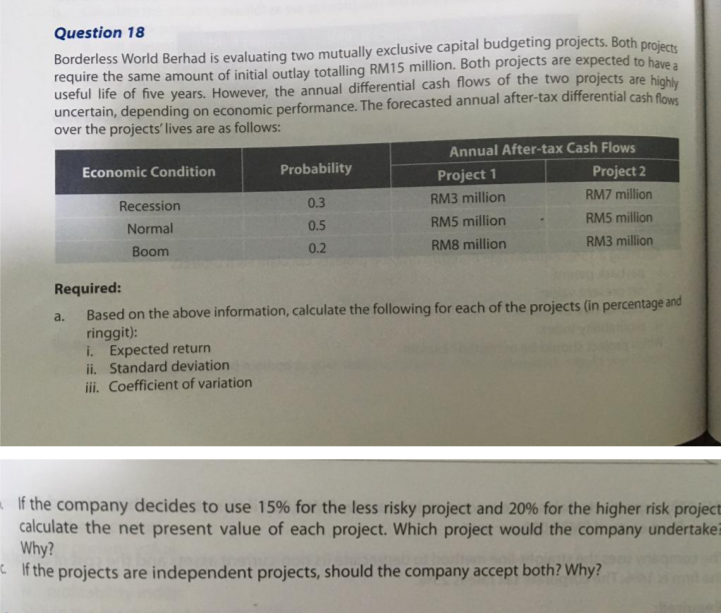

Question 18 Borderless World Berhad is evaluating two mutually exclusive capital budgeting projects. Both projects require the same amount of initial outlay totalling RM15 million. Both projects are expected to have a useful life of five years. However, the annual differential cash flows of the two projects are highly uncertain, depending on economic performance. The forecasted annual after-tax differential cash flows over the projects' lives are as follows: Economic Condition Probability Annual After-tax Cash Flows Project 1 Project 2 RM3 million RM7 million RM5 million RM5 million RM8 million RM3 million Recession Normal Boom 0.3 0.5 0.2 a. Required: Based on the above information, calculate the following for each of the projects (in percentage and ringgit): i. Expected return ii. Standard deviation iii. Coefficient of variation If the company decides to use 15% for the less risky project and 20% for the higher risk project calculate the net present value of each project. Which project would the company undertake Why? c If the projects are independent projects, should the company accept both? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts