Question: Question: 18An assisted-living facility provides services in the form of residential space, meals, and other occupant assistance (OOA) to its occupants. The facility currently

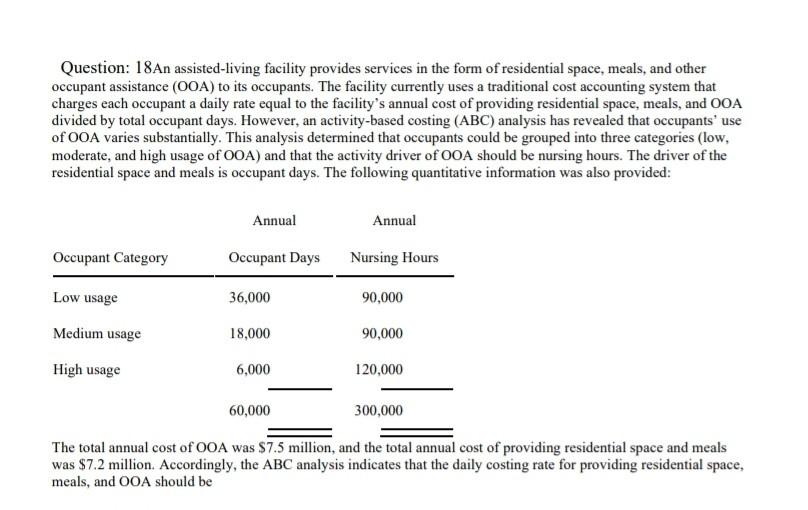

Question: 18An assisted-living facility provides services in the form of residential space, meals, and other occupant assistance (OOA) to its occupants. The facility currently uses a traditional cost accounting system that charges each occupant a daily rate equal to the facility's annual cost of providing residential space, meals, and OOA divided by total occupant days. However, an activity-based costing (ABC) analysis has revealed that occupants' use of OOA varies substantially. This analysis determined that occupants could be grouped into three categories (low, moderate, and high usage of OOA) and that the activity driver of OOA should be nursing hours. The driver of the residential space and meals is occupant days. The following quantitative information was also provided: Occupant Category Low usage Medium usage High usage Annual Occupant Days 36,000 18,000 6,000 60,000 Annual Nursing Hours 90,000 90,000 120,000 300,000 The total annual cost of OOA was $7.5 million, and the total annual cost of providing residential space and meals was $7.2 million. Accordingly, the ABC analysis indicates that the daily costing rate for providing residential space, meals, and OOA should be

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

To calculate the daily costing rate for providing residential space meals and occupant assistance OOA using activitybased costing ABC we need to allocate the total costs based on the activity drivers ... View full answer

Get step-by-step solutions from verified subject matter experts