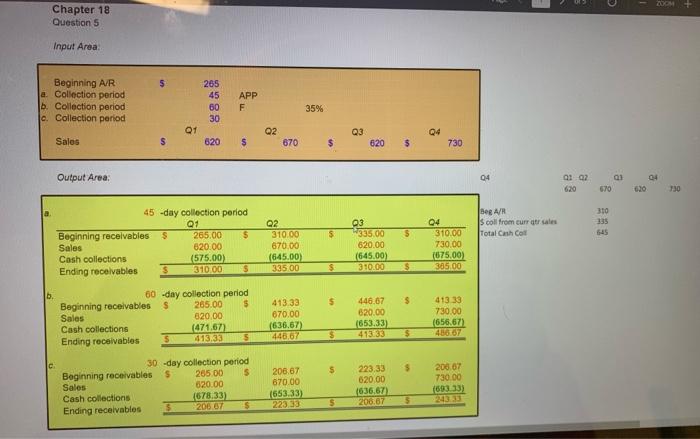

Question: question 19 Chapter 18 Question 5 Input Area: Beginning A/R a. Collection period b. Collection period c. Collection period Sales Output Area: Beginning receivables $

question 19

question 19

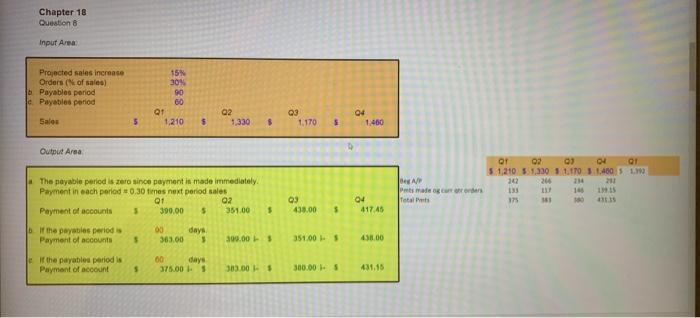

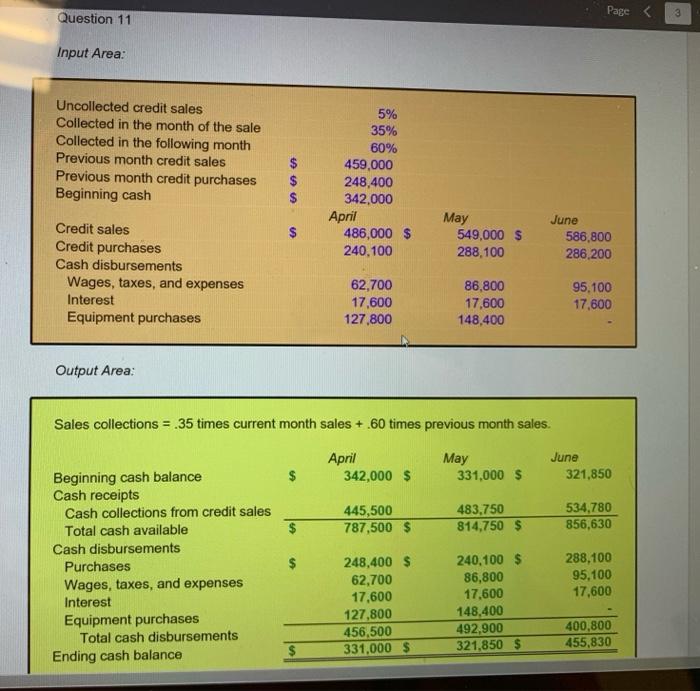

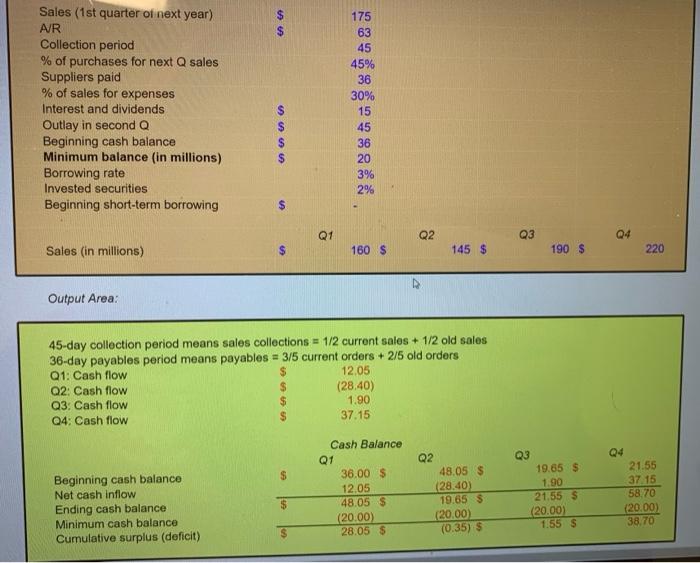

Chapter 18 Question 5 Input Area: Beginning A/R a. Collection period b. Collection period c. Collection period Sales Output Area: Beginning receivables $ Sales Cash collections Ending receivables Beginning receivables Sales Cash collections Ending receivables Beginning receivables Sales Cash collections Ending receivables a b. C 265 45 APP 60 F 30 S 620 $ 45 -day collection period Q1 265.00 $ 620.00 (575.00) 310,00 $ $ 60-day collection period 265.00 $ 620.00 (471.67) 413.33 S 30-day collection period S 265.00 S 620.00 (678.33) 206.67 $ $ Q1 Q2 Q2 670 310.00 670,00 (645.00) 335.00 413.33 670.00 (636.67) 446.67 206.67 670.00 (653.33) 223.33 35% $ $ $ $ $ S $ Q3 Q3 620 $ 335.00 $ 620.00 (645.00) 310.00 $ 446.67 $ 620.00 (653.33) 413.33 $ 223.33 $ 620.00 (636.67) 206.67 $ 04 730 310.00 730.00 (675.00) 365.00 413 33 730.00 (656.67) 486.67 206.67 730.00 (693.33) 243.33 Q4 Beg A/R S coll from curr ger sales Total Cash Coll 01 02 620 670 310 335 645 a ZOOM 2 730 Chapter 18 Question 8 Input Area: 15% 30% Projected sales increase Orders (of sales) bPayables period e. Payables period 90 60 02 1,330 Sales 1,210 S $ Output Area The payable period is zero since payment is made immediately. Payment in each period 0.30 times next period sales Q1 390.00 02 351.00 Payment of accounts S 5 $ b. If the payables period is Payment of accounts 00 days. 363.00 S $ 300.00 $ 60 e if the payables period is Payment of account days 375.00 $ $ 383.00 - $ Q1 Q3 1,170 03 438.00 S S 351.00 $ 300.00 $ 04 1,460 04 417.45 438.00 431.15 deg A/P Pets made og cur or orders Total Pets QT 02 04 Q1 $1,210 $1,330 $ 1.170 $ 1.400 1.390 242 244 234 201 133 137 146 1945 431.35 375 363 Question 11 Input Area: 5% 35% Uncollected credit sales Collected in the month of the sale Collected in the following month Previous month credit sales Previous month credit purchases Beginning cash 60% 459,000 248,400 342,000 Credit sales 486,000 $ 549,000 $ Credit purchases 240,100 288,100 Cash disbursements Wages, taxes, and expenses 62,700 86,800 Interest 17,600 17,600 Equipment purchases 127,800 148,400 Output Area: Sales collections = .35 times current month sales + .60 times previous month sales. April May June Beginning cash balance 342,000 $ 331,000 $ Cash receipts Cash collections from credit sales 445,500 483,750 Total cash available 787,500 $ 814,750 $ Cash disbursements Purchases 248,400 $ 240,100 $ 86,800 62,700 Wages, taxes, and expenses 17,600 Interest 17,600 127,800 148,400 Equipment purchases 456,500 492,900 Total cash disbursements 331,000 $ 321,850 $ Ending cash balance $ $ $ $ April May June Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts