Question: Question 2 (1 mark) You need to repay a loan of ( mathrm{R} 80000 ) over a period of 30 months at an annual interest

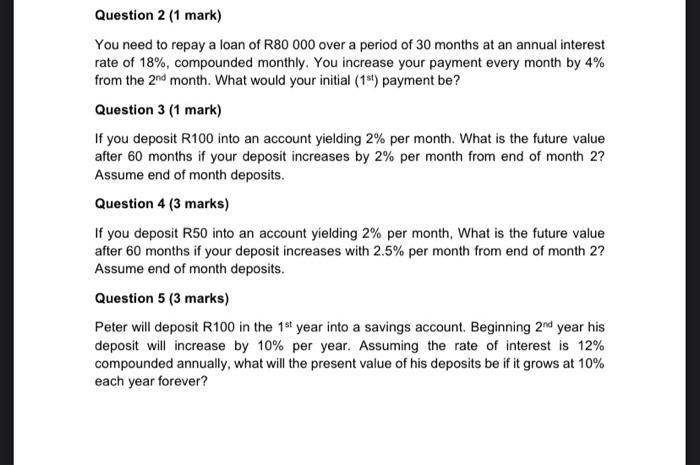

Question 2 (1 mark) You need to repay a loan of \\( \\mathrm{R} 80000 \\) over a period of 30 months at an annual interest rate of \18, compounded monthly. You increase your payment every month by \4 from the \\( 2^{\\text {nd }} \\) month. What would your initial (1st) payment be? Question 3 (1 mark) If you deposit R100 into an account yielding \2 per month. What is the future value after 60 months if your deposit increases by \2 per month from end of month 2 ? Assume end of month deposits. Question 4 (3 marks) If you deposit R50 into an account yielding \2 per month, What is the future value after 60 months if your deposit increases with \2.5 per month from end of month 2 ? Assume end of month deposits. Question 5 (3 marks) Peter will deposit R100 in the \\( 1^{\\text {st }} \\) year into a savings account. Beginning \\( 2^{\\text {nd }} \\) year his deposit will increase by \10 per year. Assuming the rate of interest is \12 compounded annually, what will the present value of his deposits be if it grows at \10 each year forever

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts