Question: Question 2 ( 2 0 points ) On July 1 , 2 0 2 4 , Adam, Brian, Charlie and Dave decide to form Newco

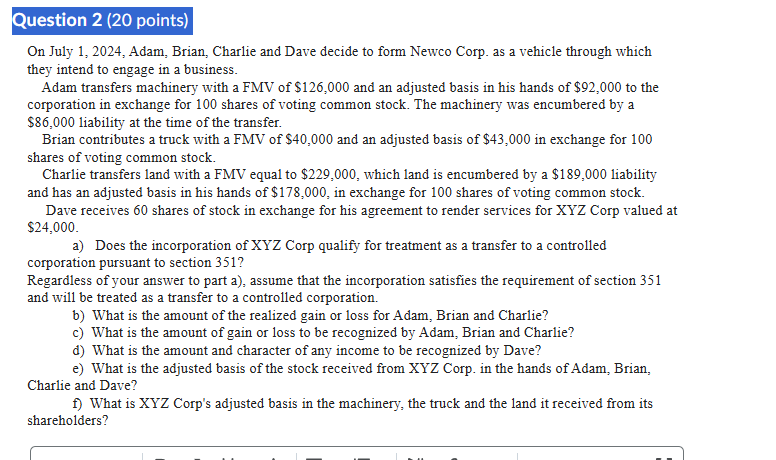

Question points On July Adam, Brian, Charlie and Dave decide to form Newco Corp. as a vehicle through which they intend to engage in a business. Adam transfers machinery with a FMV of $ and an adjusted basis in his hands of $ to the corporation in exchange for shares of voting common stock. The machinery was encumbered by a $ liability at the time of the transfer. Brian contributes a truck with a FMV of $ and an adjusted basis of $ in exchange for shares of voting common stock. Charlie transfers land with a FMV equal to $ which land is encumbered by a $ liability and has an adjusted basis in his hands of $ in exchange for shares of voting common stock. Dave receives shares of stock in exchange for his agreement to render services for XYZ Corp valued at $ a Does the incorporation of XYZ Corp qualify for treatment as a transfer to a controlled corporation pursuant to section Regardless of your answer to part a assume that the incorporation satisfies the requirement of section and will be treated as a transfer to a controlled corporation. b What is the amount of the realized gain or loss for Adam, Brian and Charlie? c What is the amount of gain or loss to be recognized by Adam, Brian and Charlie? d What is the amount and character of any income to be recognized by Dave? e What is the adjusted basis of the stock received from XYZ Corp. in the hands of Adam, Brian, Charlie and Dave? f What is XYZ Corp's adjusted basis in the machinery, the truck and the land it received from its shareholders?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock