Question: Question 2 (20 marks) Li & Lung Ltd intends to make use of its weighted average of cost of capital (WACC) to evaluate a potential

Question 2 (20 marks)

Question 2 (20 marks)

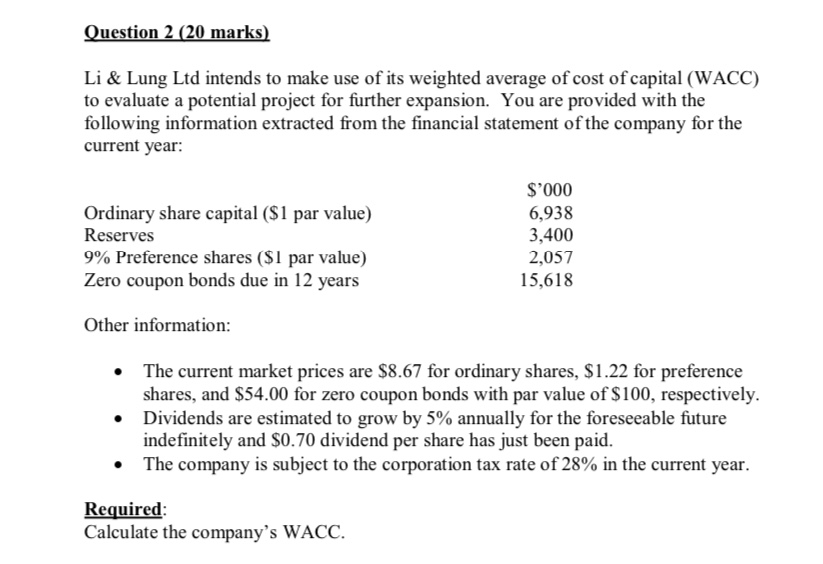

Li & Lung Ltd intends to make use of its weighted average of cost of capital (WACC) to evaluate a potential project for further expansion. You are provided with the following information extracted from the financial statement of the company for the current year:

Ordinary share capital ($1 par value) Reserves 9% Preference shares ($1 par value) Zero coupon bonds due in 12 years

Other information:

$0006,938 3,400 2,057

15,618

-

The current market prices are $8.67 for ordinary shares, $1.22 for preference shares, and $54.00 for zero coupon bonds with par value of $100, respectively.

-

Dividends are estimated to grow by 5% annually for the foreseeable future indefinitely and $0.70 dividend per share has just been paid.

-

The company is subject to the corporation tax rate of 28% in the current year.Required:

Calculate the companys WACC.

Question 2 (20 marks) Li & Lung Ltd intends to make use of its weighted average of cost of capital (WACC) to evaluate a potential project for further expansion. You are provided with the following information extracted from the financial statement of the company for the current year: Ordinary share capital ($1 par value) Reserves 9% Preference shares ($1 par value) Zero coupon bonds due in 12 years $'000 6,938 3,400 2,057 15,618 Other information: The current market prices are $8.67 for ordinary shares, $1.22 for preference shares, and $54.00 for zero coupon bonds with par value of $100, respectively. Dividends are estimated to grow by 5% annually for the foreseeable future indefinitely and $0.70 dividend per share has just been paid. The company is subject to the corporation tax rate of 28% in the current year. Required: Calculate the company's WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts