Question: Question 2 (20 points): The average return for Firm A is calculated as 0.05 (5%) with a standard deviation of 0.03. The average return for

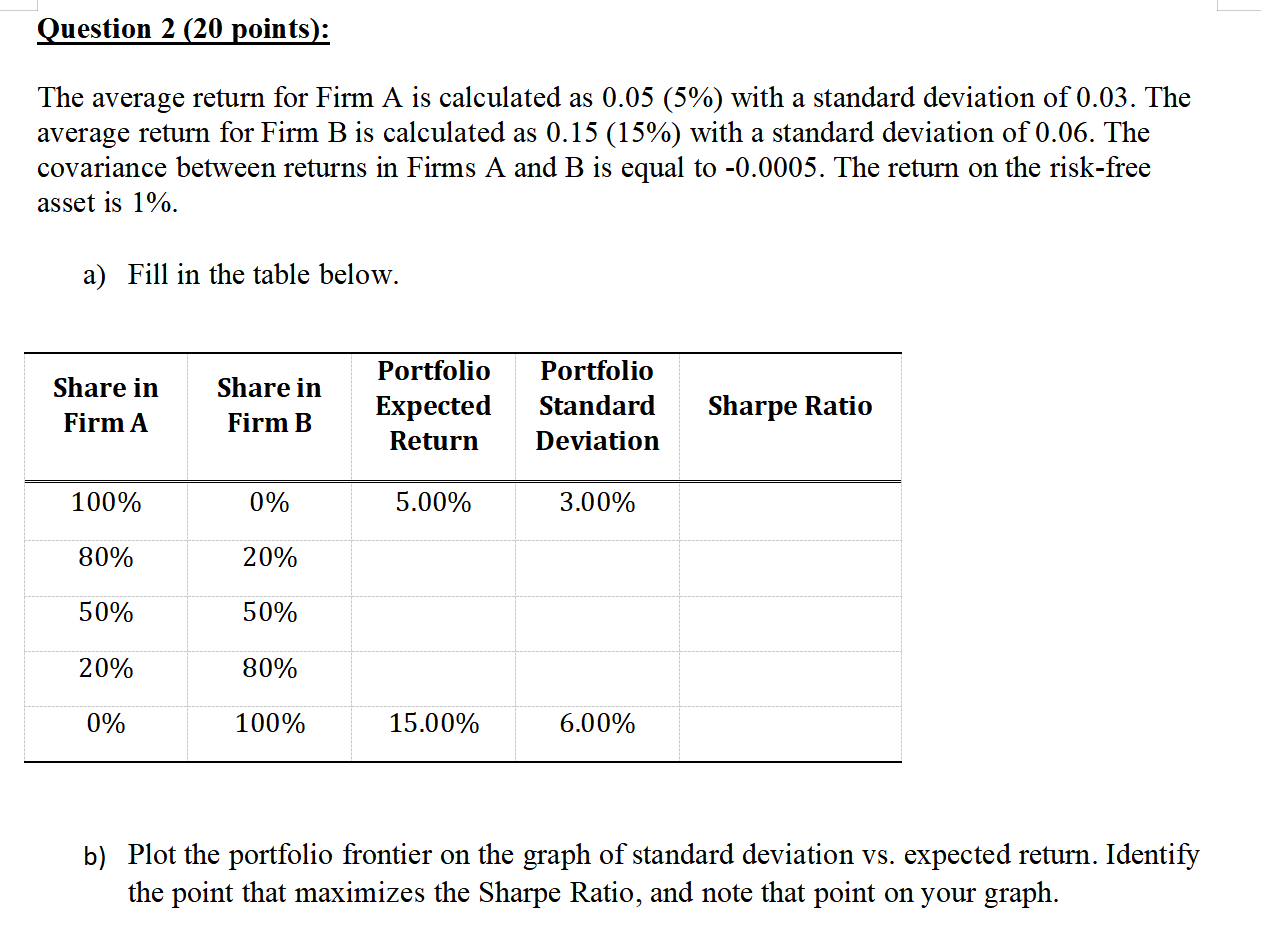

Question 2 (20 points): The average return for Firm A is calculated as 0.05 (5%) with a standard deviation of 0.03. The average return for Firm B is calculated as 0.15 (15%) with a standard deviation of 0.06. The covariance between returns in Firms A and B is equal to -0.0005. The return on the risk-free asset is 1%. a) Fill in the table below. Share in Firm A Share in Firm B Portfolio Expected Return Portfolio Standard Deviation Sharpe Ratio 100% 0% 5.00% 3.00% 80% 20% 50% 50% 20% 80% 0% 100% 15.00% 6.00% b) Plot the portfolio frontier on the graph of standard deviation vs. expected return. Identify the point that maximizes the Sharpe Ratio, and note that point on your graph. Question 2 (20 points): The average return for Firm A is calculated as 0.05 (5%) with a standard deviation of 0.03. The average return for Firm B is calculated as 0.15 (15%) with a standard deviation of 0.06. The covariance between returns in Firms A and B is equal to -0.0005. The return on the risk-free asset is 1%. a) Fill in the table below. Share in Firm A Share in Firm B Portfolio Expected Return Portfolio Standard Deviation Sharpe Ratio 100% 0% 5.00% 3.00% 80% 20% 50% 50% 20% 80% 0% 100% 15.00% 6.00% b) Plot the portfolio frontier on the graph of standard deviation vs. expected return. Identify the point that maximizes the Sharpe Ratio, and note that point on your graph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts