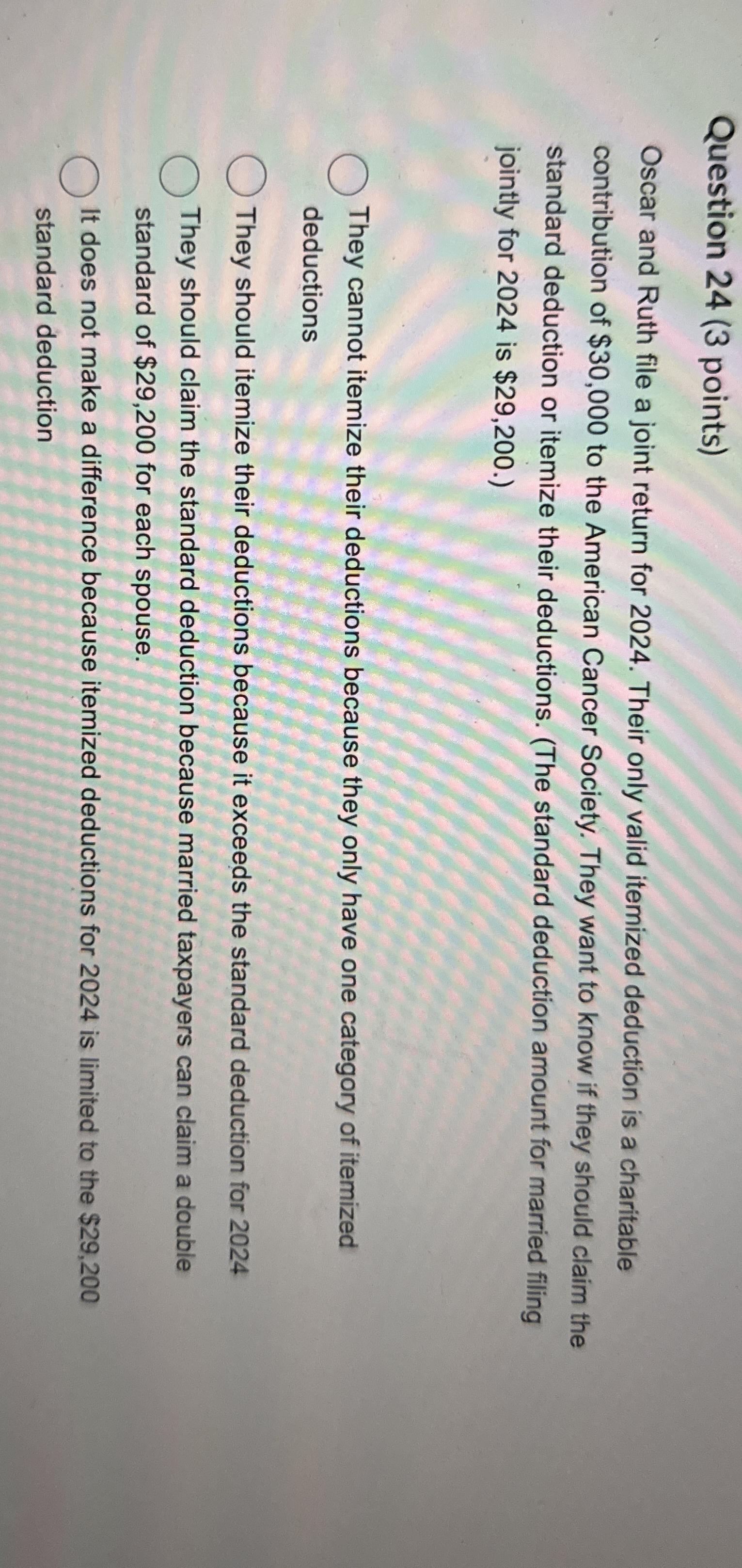

Question: Question 2 4 ( 3 points ) Oscar and Ruth file a joint return for 2 0 2 4 . Their only valid itemized deduction

Question points

Oscar and Ruth file a joint return for Their only valid itemized deduction is a charitable contribution of $ to the American Cancer Society. They want to know if they should claim the standard deduction or itemize their deductions. The standard deduction amount for married filing jointly for is $

They cannot itemize their deductions because they only have one category of itemized deductions

They should itemize their deductions because it exceeds the standard deduction for

They should claim the standard deduction because married taxpayers can claim a double standard of $ for each spouse.

It does not make a difference because itemized deductions for is limited to the $ standard deduction

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock