Question: Question 2 A bank is considering using a three against six $ 2 , 0 0 0 , 0 0 0 FRA to cover its

Question

A bank is considering using a "three against six" $ FRA to cover its potential loss.

The purpose of the FRA is to cover the interest rate risk caused by the maturity mismatch

from having made a sixmonth Eurodollar loan and having accepted a threemonth

Eurodollar deposit. The agreement rate with the buyer is There are actually days in

the threemonth FRA period. Which one of following statements is correct?

If the settlement rate is three months from today, then the FRA is worth $

Without the FRA, the bank will lose if the market interest rate drops at the end of three months.

If the settlement rate is three months from today, then the buyer pays the seller.

To hedge the loss caused by maturity mismatch, the bank should be a seller of the FRA.

To hedge the risk caused by maturity mismatch, the bank could take the buyer's position if it uses

the EuroDollar Interest Rate Futures instead. Question

pts

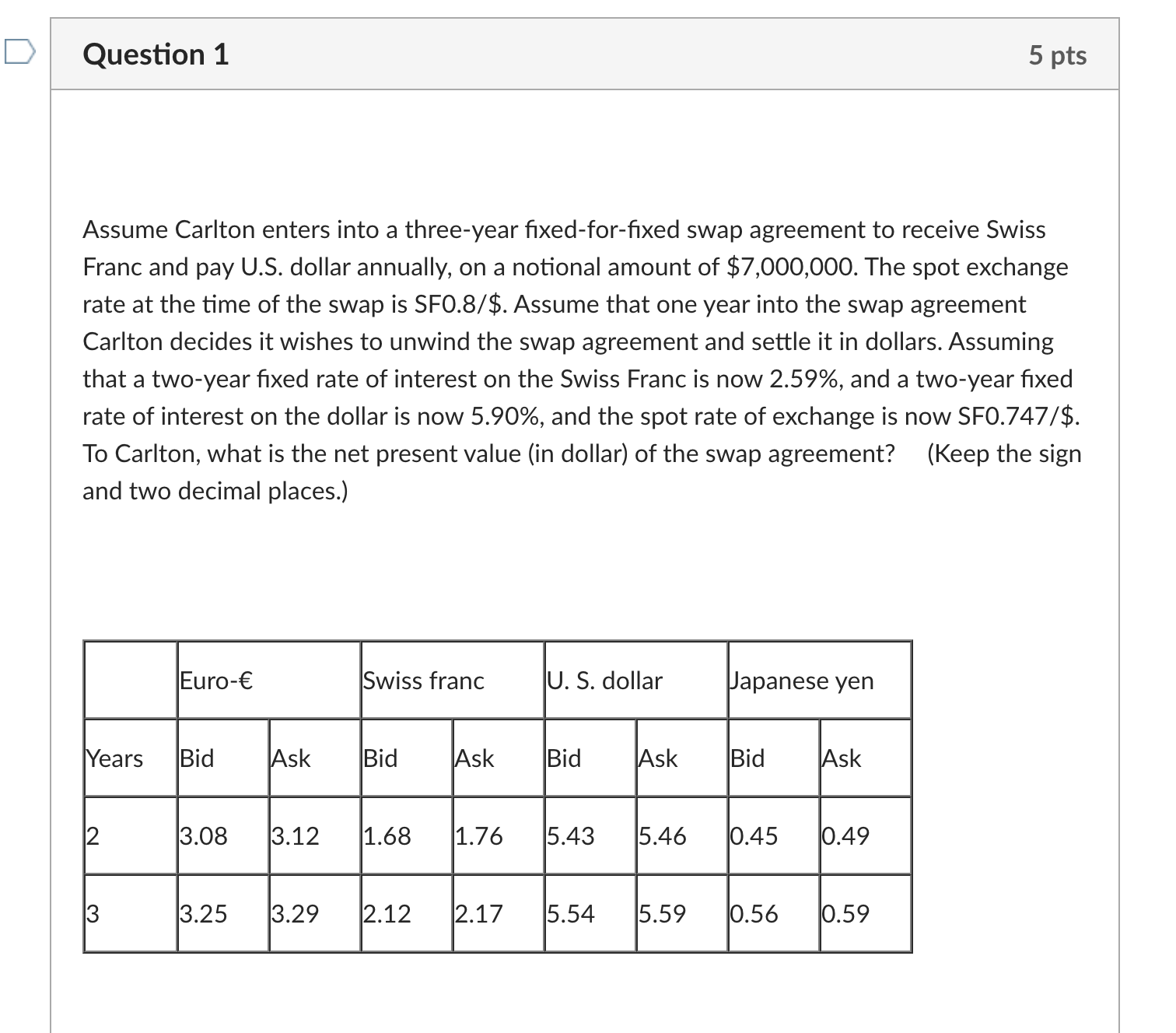

Assume Carlton enters into a threeyear fixedforfixed swap agreement to receive Swiss Franc and pay US dollar annually, on a notional amount of $ The spot exchange rate at the time of the swap is SF$ Assume that one year into the swap agreement Carlton decides it wishes to unwind the swap agreement and settle it in dollars. Assuming that a twoyear fixed rate of interest on the Swiss Franc is now and a twoyear fixed rate of interest on the dollar is now and the spot rate of exchange is now SF$ To Carlton, what is the net present value in dollar of the swap agreement? Keep the sign and two decimal places.

tableEuroSwiss franc,U S dollar,Japanese yenYearsBid,Ask,Bid,Ask,Bid,Ask,Bid,Ask

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock