Question: Question 2: A capital investment project will require an initial outlay of $110,000 and is expected to generate an after-tax net cash flow of CF1=$10,000

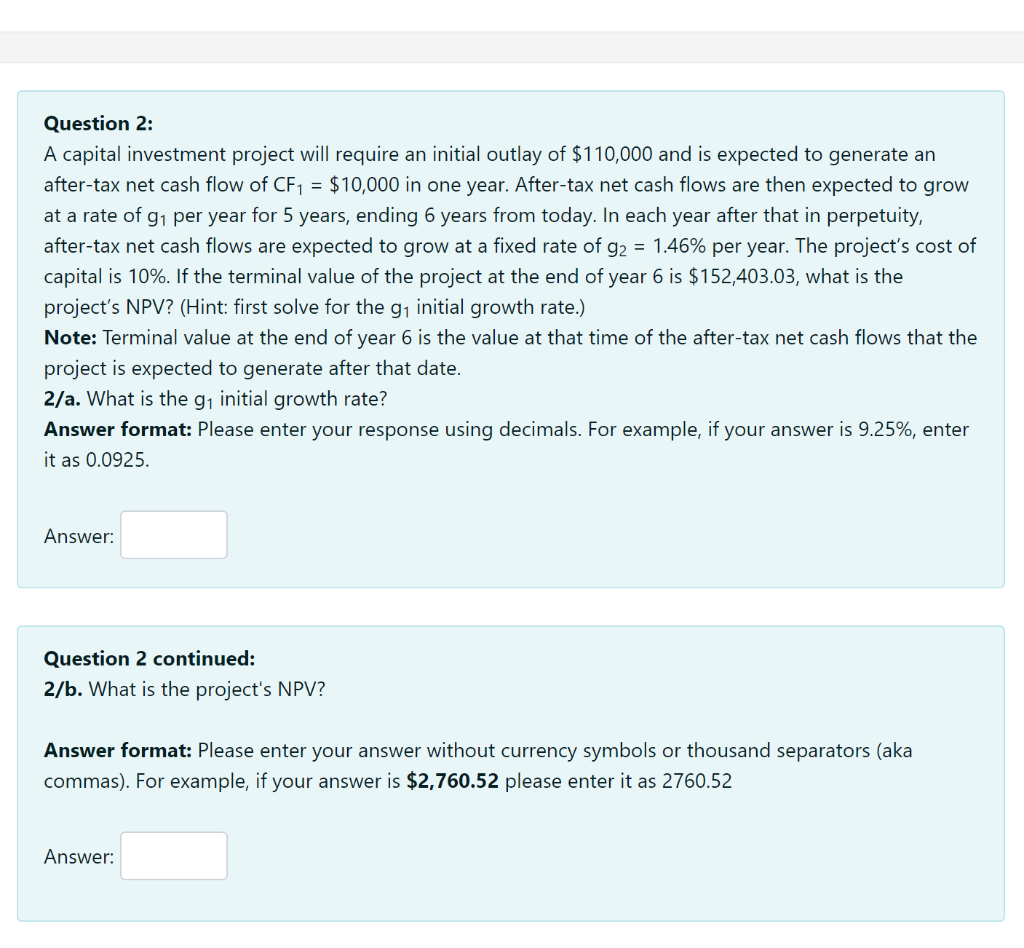

Question 2: A capital investment project will require an initial outlay of $110,000 and is expected to generate an after-tax net cash flow of CF1=$10,000 in one year. After-tax net cash flows are then expected to grow at a rate of g1 per year for 5 years, ending 6 years from today. In each year after that in perpetuity, after-tax net cash flows are expected to grow at a fixed rate of g2=1.46% per year. The project's cost of capital is 10%. If the terminal value of the project at the end of year 6 is $152,403.03, what is the project's NPV? (Hint: first solve for the g1 initial growth rate.) Note: Terminal value at the end of year 6 is the value at that time of the after-tax net cash flows that the project is expected to generate after that date. 2/a. What is the g1 initial growth rate? Answer format: Please enter your response using decimals. For example, if your answer is 9.25%, enter it as 0.0925. Answer: Question 2 continued: 2/b. What is the project's NPV? Answer format: Please enter your answer without currency symbols or thousand separators (aka commas). For example, if your answer is $2,760.52 please enter it as 2760.52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts