Question: Question 2. (a) Explain the difference between making decisions under uncertainty and under risky conditions. [4 marks) (b) Describe the conditions that would allow decisions

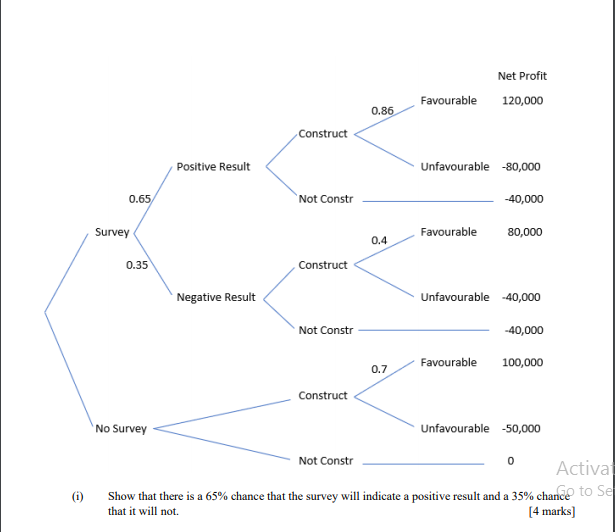

Question 2. (a) Explain the difference between making decisions under uncertainty and under risky conditions. [4 marks) (b) Describe the conditions that would allow decisions using Laplace decision-making and decisions made using Hurwicz decision-making to always be identical. [4 marks] (c) A real-estate developer has the choice to construct a new apartment complex. If the housing market is favourable, they will earn significant profits, but if it is not, they stand to lose significant amounts. Suppose that of all new products with a favourable market (F), market surveys were positive and predicted success correctly 80% of the time. That is: Pr(positive|F)=0.8. On the other hand, when there was actually an unfavourable market (U) for a new product, the surveys incorrectly predicted positive results 30% of the time. That is, Pr(positive|U)=0.3. The prior probabilities of a favourable market and an unfavourable market are 0.7 and 0.3 respectively. To aid the developers' decision-making they can pay for a survey to give them better information on whether the housing market will be favourable or not. The entire decision, including relevant probabilities and all possible net profit amounts are included in the diagram below: Net Profit 120,000 Favourable 0.86 Construct Positive Result Unfavourable -80,000 0.65 Not Constr -40,000 Survey Favourable 80,000 0.4 0.35 Construct Negative Result Unfavourable -40,000 Not Constr -40,000 0.7 Favourable 100,000 Construct No Survey Unfavourable -50,000 Not Constr Activat Show that there is a 65% chance that the survey will indicate a positive result and a 35% chance to se that it will not [4 marks] (1) (ii) 0.86. (iii) Show that the probability of a Favourable Market given that a positive survey was obtained is (4 marks) Calculate the Expected Monetary Value of the decision represented in the decision tree. (4 marks]tiva Go to Se

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts