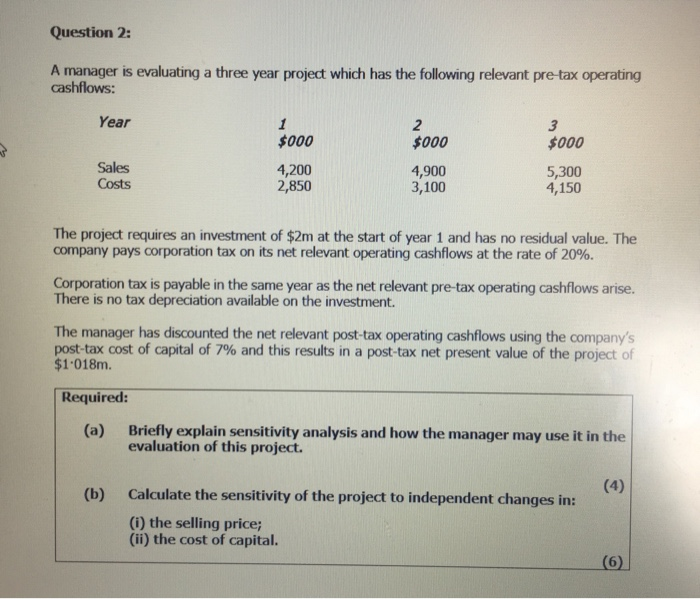

Question: Question 2: A manager is evaluating a three year project which has the following relevant pre tax operating cashflows: Year $000 2 $000 3 $000

Question 2: A manager is evaluating a three year project which has the following relevant pre tax operating cashflows: Year $000 2 $000 3 $000 Sales Costs 4,200 2,850 4,900 3,100 5,300 4,150 The project requires an investment of $2m at the start of year 1 and has no residual value. The company pays corporation tax on its net relevant operating cashflows at the rate of 20%. Corporation tax is payable in the same year as the net relevant pre-tax operating cashflows arise. There is no tax depreciation available on the investment. The manager has discounted the net relevant post-tax operating cashflows using the company's post-tax cost of capital of 7% and this results in a post-tax net present value of the project of $1.018m. Required: (a) Briefly explain sensitivity analysis and how the manager may use it in the evaluation of this project. (b) (4) Calculate the sensitivity of the project to independent changes in: (i) the selling price; (ii) the cost of capital. (6)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts