Question: QUESTION 2 (a) Parson plc has entered into the following transactions during the year ended 31 December 20X3. i. On 1 October 20X3 Parson plc

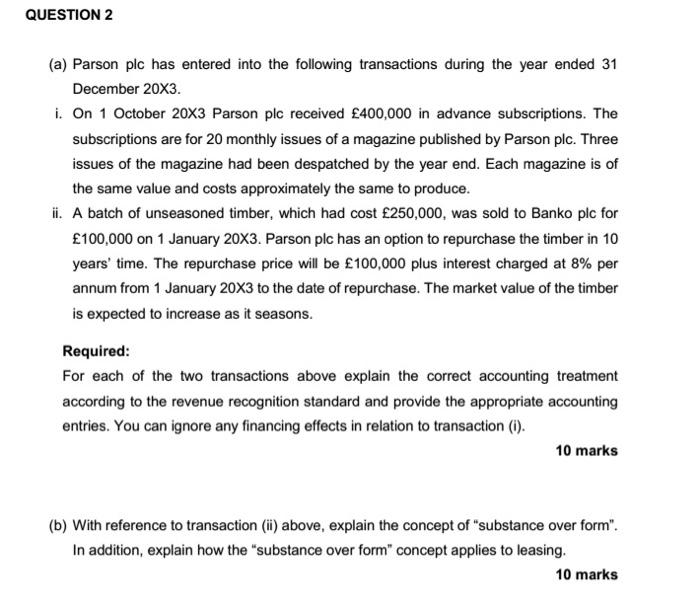

QUESTION 2 (a) Parson plc has entered into the following transactions during the year ended 31 December 20X3. i. On 1 October 20X3 Parson plc received 400,000 in advance subscriptions. The subscriptions are for 20 monthly issues of a magazine published by Parson plc. Three issues of the magazine had been despatched by the year end. Each magazine is of the same value and costs approximately the same to produce. ii. A batch of unseasoned timber, which had cost 250,000, was sold to Banko plc for 100,000 on 1 January 20X3. Parson plc has an option to repurchase the timber in 10 years' time. The repurchase price will be 100,000 plus interest charged at 8% per annum from 1 January 20X3 to the date of repurchase. The market value of the timber is expected to increase as it seasons. Required: For each of the two transactions above explain the correct accounting treatment according to the revenue recognition standard and provide the appropriate accounting entries. You can ignore any financing effects in relation to transaction (). 10 marks (b) With reference to transaction (i) above, explain the concept of "substance over form. In addition, explain how the "substance over form" concept applies to leasing. 10 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts