Question: Question 2 A pension fund manager is considering two mutual funds, S and B, as follows: Expected return, E(r) Standard deviation, o Stock fund (S)

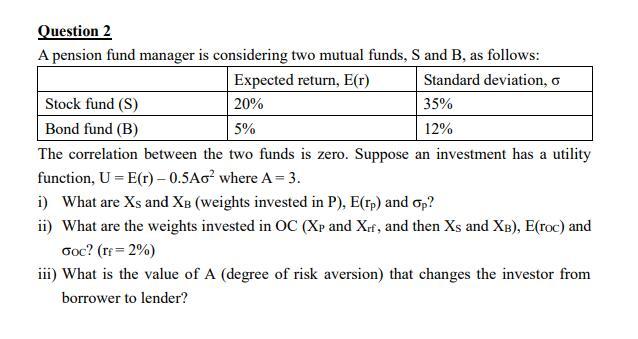

Question 2 A pension fund manager is considering two mutual funds, S and B, as follows: Expected return, E(r) Standard deviation, o Stock fund (S) 20% 35% Bond fund (B) 5% 12% The correlation between the two funds is zero. Suppose an investment has a utility function, U = E(r) - 0.5Aowhere A = 3. i) What are Xs and XB (weights invested in P), E(Tp) and op? ii) What are the weights invested in OC (Xp and Xrf, and then Xs and XB), E(roc) and Goc? (re=2%) iii) What is the value of A (degree of risk aversion) that changes the investor from borrower to lender

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts