Question: In July 2017, Sonex Company purchased machinery with an estimated 10-year life. The purchase price of the machinery was $35,000, sales tax $2,500, installation

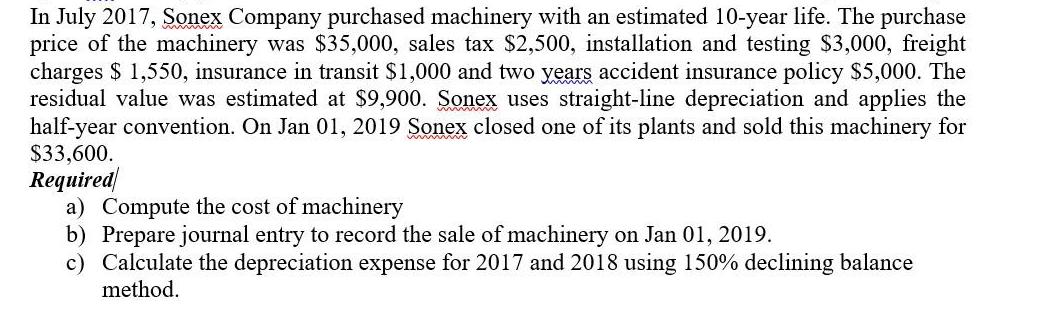

In July 2017, Sonex Company purchased machinery with an estimated 10-year life. The purchase price of the machinery was $35,000, sales tax $2,500, installation and testing $3,000, freight charges $ 1,550, insurance in transit $1,000 and two years accident insurance policy $5,000. The residual value was estimated at $9,900. Sonex uses straight-line depreciation and applies the half-year convention. On Jan 01, 2019 Sonex closed one of its plants and sold this machinery for $33,600. Required a) Compute the cost of machinery b) Prepare journal entry to record the sale of machinery on Jan 01, 2019. c) Calculate the depreciation expense for 2017 and 2018 using 150% declining balance method.

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts